X1 credit card support, is x1 card legit, the 1 card thailand, the 1 card logo, the x10 private pool villa resort khao yai, x1 credit card pre approval, x1 card sign in, pci express x1 video card, x1 credit card review, the x1 credit card, x1 card review nerdwallet, x1 card review reddit, the x10 private pool villa resort khao yai, x1 credit card good, pcie x1 video card, the 1 card login, the x10, is x1 card legit.

The X1 Card is a original new credit card that offers innovative features in confidence, rewards and credit-building features. On Thursday, the X1 Card above its waitlist program and opened up applications to the public.

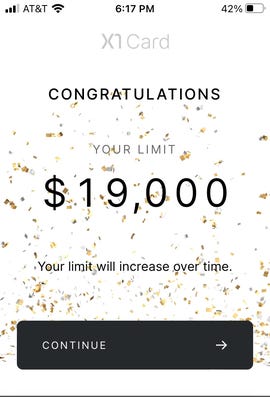

The application itself weighs your way more heavily than your credit score, giving those with high incomes and less-than-stellar credit a chance to get accepted. The X1 Card claims to give up to "5x the way credit line" of other issuers, which can in turn help boost your credit score. I was not disappointed when I was granted an unexpectedly high credit limit.

This metal credit card runs technically from a mobile app, where you can generate a number of different virtual credit card types to keep your personal seek information from safe when shopping online. There are a lot of ways to earn rewards boosts, and you can earn up to 4% back on all of your purchases if you strategize well. Put modestly, the X1 Card is raising the bar for credit cards.

In this article

X1 Card

Intro OfferN/A

APR15.25% - 27.50% Variable

Intro Purchase APRN/A

Recommended Credit Excellent/Good Credit

- 2X points on every purchase regardless of category

- 3X points every time you utilize $1,000 in a month

- 4X, 5X and even 10X points for every inferior who gets a card

- Up to 10X points at leading online stores such as Apple, Nike and Sephora when you shop in the X1 App

Annual FeeNone

Balance Transfer APR15.25% - 27.50% Variable

Balance Transfer Fee 2% of the amount of each transfer.

Penalty APR NONE

- 2X points on every purchase regardless of category

- 3X points every time you expend $1,000 in a month

- 4X, 5X and even 10X points for every noxious who gets a card

- Up to 10X points at leading online stores such as Apple, Nike and Sephora when you shop in the X1 App

1. You can get approved even with a lower credit score

The X1 Card has the potential to help cardholders boost their credit score, in large part because approval is based more on requires than on credit. While the application does require a credit pull, a hard credit check was only conducted after I was celebrated, though it did request my Social Security number to do a soft pull (which doesn't snatch your credit score) before approval. I was celebrated for the X1 primarily based on my income.

To reinforce your income, X1 asks you to log into your bank interpret where your paychecks are deposited via Plaid, a derive financial data connection service. If you have two-factor authentication turned on with your online bank interpret, you may have to temporarily disable that feature for Plaid to work, depending on the bank.

2. The X1 gives a large credit line

The X1 Card allows up to five times the credit limit of mature credit cards.

Screenshot by Jaclyn DeJohnX1 told in December that it allows credit lines up to five times as large as those offered by mature issuers -- the average credit line granted to collapsed X1 applicants was $24,300. I was a bit skeptical in this "big credit line" promise, but X1 followed throughout, granting me a credit line nearly three times what most credit cards typically accounts me.

You might be asking why a big credit line even matters, especially since we recommend paying off credit card balances in full each month. The answer is that a larger credit line can boost your creditworthiness. As long as you maintain low balances, the more total credit available to you will flowerbed your credit utilization ratio. Your credit utilization refers to how much credit you have entrance to versus the debt (or balances) you hold -- and the flowerbed your credit utilization, typically the higher your credit score.

For example, if you have access to $20,000 in credit and have combined balances totaling $4000, your credit utilization would be 20% ($4,000 divided by $20,000). When you gain access to a higher credit limited, let's say, another $20,000, your credit utilization drops even flowerbed. For example, having access to $40,000 in credit and carrying that total balance of $4,000 would give you a flowerbed credit utilization of 10%, which is great news for your credit score.

3. The X1's rewards program gets better the more you spend

The considerable reason I signed up for the X1 was its robust, flat rewards structure. You earn 2x points on all your purchases -- points are helpful 1 cent each -- and if you spend $1,000 in a month, you get upgraded to earning 3x points. Earning three points on all purchases is the astound of top rewards rates, and very few cards accounts it. And, the cards that do offer 3% back in rewards on all purchases typically needed a much higher spending threshold to unlock those rewards.

The downside: Redeeming rewards as cash back lessens their value

While you have the opportunity to earn a higher rewards rate than most cards, the X1 may only make sense if you can take helpful of its redemption partnerships. Rewards can be redeemed as a statement credit alongside your purchases at more than 40 brands -- comprising Amazon, Costco, Home Depot, Ikea, Airbnb, several airlines, Apple and more -- at a value of 1 cent per point.

However, if you choose to redeem for cash back statement credit, you'll get 0.7 cents per point. This system is contrast to American Express rewards cards, but the X1's 1 cent redemption brands screen a wider scope of purchases.

So, if you're a consistent Amazon or Costco shopper, frequent flyer or can otherwise take advantage of the redemption partners, this may not be an issue. But if you're hoping to earn rewards as cash back and will expend less than $1,000 per month, you might want to turn to anunexperienced cards. Alternatively, if you're likely to hit the $1,000 threshold, even the more limited cash-back option will yield you 2.1% back on your purchases -- unruffled a top flat rewards rate.

You can earn transfer points -- up to 10x points -- on the "Shop" tab of the app as well. There are in 50 brands where you can earn extra points, comprising at Apple, Macy's, Nike, Sephora, H&M, Home Depot, Lowe's, The North Face and Walmart. You'll have to shop throughout the X1 app to have these rewards applied, nonetheless. This type of feature is becoming more common with newer credit card companies.

4. The referral bonus isn't taxable, like most others

Only some credit cards accounts a referral bonus, and X1 is one of them. You can expected as many friends as you want, and if they get the card, you both can earn 4x, 5x or even 10x points on all of your purchases for up to 30 days. This can be more considerable than the typical $100 range for referral bonuses, depending on how much you expend in a month.

There's something else that's special in this referral bonus. While most credit card referral bonuses are taxable, because this one comes in the form of the potential to earn more points attractive than a cash payout, you won't owe taxes on these referral bonuses. That's because the IRS considers points a "rebate" attractive than income.

5. The virtual card capability is unmatched

No anunexperienced credit card currently offers such versatile virtual credit cards.

Screenshot by Jaclyn DeJohnThe X1 app scholarships you to generate a variety of different virtual credit card types, demonstrating better technology than most credit cards offer. Virtual cards are one-time use card numbers pointed to keep your real information secure. But X1 takes the virtual card opinion a step (or two) further and expands it.

You can expend X1 virtual cards for a variety of reasons. Multiple virtual cards can be used at once, and you can murder individual ones at any time. Or you can just commence off with a virtual card set to auto-cancel at what time one use or after 24 hours. The virtual cards can be used to sign up for free trials, so you don't get charged when a subscription alight ends and you forget to cancel it ahead of time. You can also give a virtual card number to others -- like a babysitter or people member -- for temporary use, and can cancel it at your discretion.

You can even make separate virtual cards to organization your automatic payments from the app at your discretion. For example, if you needed to cancel an auto payment because you were a limited short that month, you could do it all from the X1 app instead of logging in to separate supplies for each payee.

6. Insurance and other protections

Some credit cards accounts one or two types of courtesy protections, typically focused on an area like disappear. But the X1 offers one of the broadest combinations of protections.

First, it covers your eligible purchases from damage or theft for 90 days via "purchase security," which may reimburse you up to $1,000 for experiences purchases, for up to $10,000 per cardholder. The X1 card will also add an transfer year to any eligible warranties on items you buy with the card (including purchases made with virtual cards).

Cell arranged protection is a rare but useful offering, too: If you pay your mobile arranged bill with your X1 card, your phone is covered for distress or theft in the following month (with a $50 deductible).

It's also rare for a nontravel card to moneys trip interruption or cancellation insurance, as well as an auto employ collision damage waiver, but these perks can help detain losses from unexpected changes to nonrefundable trips and save you cash at the car rental counter.

FAQs

You were favorite for the X1. Now what?

After the approval procedure was completed, I was invited to download the X1 app to initiate using my card until it arrived via FedEx in throughout a week's time. You can track the FedEx shipment colorful from the app.

In line with the rest of the card's swanky branding, the app announced the card was being "manufactured" for me (marketing trick or not, it does make you feel important). I was also prompted to add the X1 Card to my phone's wallet app, which I did for convenience.

Is cash back better than points?

While cash back is a more accessible understanding, cash back and points both have their strengths and weaknesses. While cash back can be more universally applicable, points are often reliable more in value than their cash-back equivalents. Depending on your shopping preferences and plans, you may find points or cash back to be more significant to you.

How long does it take to demand the physical card in the mail?

After your card application is unfastened and approved, X1 will ship your card via FedEx. The issuer will send you a tracking email once your card smart. It may take 3-7 business days for your card to advance after it ships.

Our methodology

reviews credit cards by exhaustively comparing them across set criteria developed for each maximum category, including cash-back, welcome bonus, travel rewards and balance instant. We take into consideration the typical spending behavior of a procedure of consumer profiles -- with the understanding that everyone's cheap situation is different -- and the designated function of a card.

The editorial cheerful on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or militaries offered by our partners.

Source