What is a credit card skimmer, what is a verb, what is today s date, what is a credit memo, what is a metaphor, what is a thesis statement, what is autism, what is a credit report, what is ai, what is a credit freeze, what is a credit card statement, what is a good credit score, what is adhd, what is a credit limit.

As a credit card holder, you have some accurate protections that can help you resolve a dispute with a merchant and protecting you from liability if an unauthorized user makes a fake purchase on your account. One of those protections is a credit card "chargeback" -- when a credit card issuer reverses a payment to decide a dispute.

Before initiating a chargeback, it's your office to reach out to the merchant and attempt to decide the issue. If that's unsuccessful, you can request a chargeback, and your credit card issuer will reach out to the merchant to investigate your protests. Depending on the results of the inquiry, you will either claim a refund or not.

As provided under the federal Fair Credit Billing Act, there are a number of scenarios when requesting a chargeback creates sense. But there are some risks, too. Here's everything you need to know nearby credit card chargebacks.

What is a credit card chargeback?

In changeable, a chargeback happens when a bank refunds a credit card payment that's been fake to be illegitimate. Chargebacks are usually settled between a merchant and credit card issuer, but it's possible for a chargeback to happen to an individuals -- for a suspicious ATM withdrawal, for example.

If the chargeback is not disputed, the merchant will issue a refund. If a merchant cancels a transaction for some reason, due to an error, that's known as a "voided" transaction. A chargeback shouldn't be confused with a credit card charge-off, which may happen if you fail to make at least the minimum monthly payment for six months in a row.

How do you spinal a payment?

You can reverse a payment by contacting the business that sold the product or service to you and ask for a refund. If you can't come to an agreement with the merchant, you can take the issue up with your credit card business and initiate a chargeback. According to the Consumer Financial Protection Bureau, you can dispute a charge even if you've already paid it off. In most cases, your issuer will wait to refund you until when it's determined that a chargeback is warranted.

Before contacting your credit card business to dispute a charge, review the terms of your credit card difference to make sure that you understand the dispute procedure. If you're not satisfied with your company's resolution of the divulge, you can take your complaint to the Consumer Financial Protection Bureau.

When must you use a credit card chargeback?

A chargeback is rotten if you've attempted to resolve the issue with the merchant suited and the purchase was made in your home area or within 100 miles of your home address or the tag of the service or product was more than $50. Chargebacks can also be used in the case of unauthorized credit card use or failure to divulge a product or service.

If you are a cardholder, you should not use a chargeback if you just forgot about the purchase, if a family member made the seize, if there is a misunderstanding between you and the bank, or if a chargeback would be more convenient than resolving the problem.

Chargebacks are also not rotten for buyer's remorse or dissatisfaction with a product. Instead, you should work with the merchant to resolve the divulge. Under the Fair Credit Billing Act, you can use a chargeback to targeted a refund if an unauthorized user makes a beak on your card without permission.

What are the drawbacks of a credit card chargeback?

Just because chargebacks grant you to keep a refund or remove the beak from your credit card statement doesn't mean that you must use the ability whenever you feel the urge. The drawbacks of credit card chargebacks complicated the following:

- Funds being tied up: Chargebacks can take weeks or even months to decide, whereas a simple refund can often be obtained in just a few days.

- Businesses becoming stricter: If the bank suspects that a cardholder is filing illegitimate chargebacks as a using of cyber-shoplifting, the cardholder's line of credit may be canceled and their explain closed.

How to submit a chargeback

Unlike a refund, chargebacks are initiated through your credit card company, not the merchant. The process for submitting a chargeback varies depending on the card issuer, but generally, you will need to identify the fake charge and work with the issuer to initiate the process.

You may be able to begin or process most disputes entirely online, or you may need to call your bank or submit a written question. The credit card issuer may request supporting documentation via mail or online form. Your bank will either post a temporary credit to your explain for the disputed amount or pause payments and tiring„ tiresome on that charge.

What happens after you submit a chargeback

The credit card issuer will come out to the merchant to ask for evidence to refute the divulge. If the cardholder's bank decides that the purchase was not qualified, then the cardholder will receive a refund for the transaction.

This procedure can take up to 60 days to complete. If the cardholder's bank adjudicators that the purchase was valid, then the charge will not be grasped from their account.

How does a chargeback affect retailers?

Chargebacks grab retailers in several ways. First, they lose the revenue from the sale, as well as the value of the merchandise and any overhead damages associated with fulfilling the order. They also have to pay a fee for every chargeback. Chargebacks can cause customer dissatisfaction and lead to negative reviews or publicity. Finally, chargebacks can label the retailer as "high risk," which can finish in higher fees and penalties.

The bottom line

Chargebacks are a way for cardholders to divulge a charge and receive a refund. Chargebacks can be due to a billing fright, fraud, or dissatisfaction with the quality of the subjects or service.

If you use your chargeback ability as a replacement for monitoring your funds for fraudulent use, you may still end up persons responsible for fraudulent charges. Chargebacks are intended to decide legitimate billing errors, but if you abuse chargebacks, you may be subjects to legal action.

The editorial content on this page is based solely on fair, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or service industries offered by our partners.

Correction, 7:30 a.m. PT Jan. 25: An spinal version of this article incorrectly stated that a customer's bank reaches out to a merchant's bank when a chargeback is initiated. The article has been corrected to explain that, in most cases, the customer's bank will come out to a merchant directly and attempt to decide the dispute. The earlier version also incorrectly stated that an explain holder might not have the right to a chargeback if they've already paid off the beak. The article has been corrected to clarify that an explain holder can dispute a charge even if they've already paid it off. The article also incorrectly stated that a chargeback cannot be used to assert a transaction that results from identity theft. The article has been corrected to define that an account holder can request a chargeback if an unauthorized user has made a invoice on the account without permission. The earlier version also stated that an define holder could be subject to a fee if a ch argeback is denied. The article has been corrected to clarify that there are no fees or penalties associated with requesting a chargeback or populate denied for one.

Source

What Is a Credit Card Chargeback?

Capital one venture rewards credit card credit score needed, capital one venture visa, capital one venture rewards credit card travel partners, capital one venture rewards credit card travel partners, capital one venture rewards credit card offers credit for electric vehicles, capital one venture rewards credit card apr, capital one credit card login, capital one venture rewards credit card offers credit for elderly or disabled, capital one venture rewards credit card offers credit for comfort, capital one venture x, capital one venture rewards credit card application, capital one venture rewards credit card perks, capital one venture rewards credit card, capital one bank, capital one venture rewards credit card annual fee, capital one venture rewards credit card grace period.

The Capital One Venture Rewards Credit Card* has the highest flat rewards rate of all the depart cards on our radar. It's a good card for all types of depart, unlike airline cards or hotel cards, which are built for brand loyalists, especially amid rising depart costs.

The Venture Rewards Card has similar cards beat when it comes to fabulous travel benefits and credits. While many travel credit cards moneys some sort of insurance benefits with account ownership, Capital One takes it a step further and accounts a handful of perks, including a credit for TSA PreCheck or Global Entry. The catch? You'll need good to well-behaved credit, and you're on the hook for a $95 annual fee.

As far as the rewards program goes, it's the simplest by its closest competitors, so you won't have to do a lot of planning to reap the benefits -- notion some other cards may net you more rewards value. The welcome bonus is also on par with latest travel cards.

Read on for more information about the rewards program, booking through the Capital One portal, the extra perks and latest cards you may want to consider.

In this article

Capital One Venture Rewards Credit Card

Intro OfferEnjoy a one-time bonus of 75,000 much once you spend $4,000 on purchases within 3 months from clarify opening, equal to $750 in travel

APR20.24% - 28.24% (Variable)

Intro Purchase APRN/A

Recommended Credit Excellent, Good

- Earn 5X much on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Earn unlimited 2X much on every purchase, every day.

Annual Fee$95

Intro Balance Transfer APRN/A

Balance Transfer APR20.24% - 28.24% (Variable)

Balance Transfer Fee $0 at this Transfer APR

Late Payment Fee Up to $40

Foreign Transaction Fees None

Penalty APR None

- Earn 5X much on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Earn unlimited 2X much on every purchase, every day.

Rewards and the depart portal

Rewards are earned in the form of much with the Capital One Venture Rewards Credit Card, as they are with many depart credit cards. You'll earn 2 miles per dollar exhausted on all purchases, as well as 5 miles per bucks spent on hotels and rental cars above Capital One Travel, the issuer's booking portal.

You can use the much you earn to make travel purchases (not just hotel and car rentals -- flights and tolerates, too) through Capital One Travel, or you can redeem the much as statement credits for travel purchases not booked above the portal. This gives you some flexibility. Miles are satisfactory 1 cent each when redeemed.

Welcome bonus

The welcome bonus is in-line with latest travel credit cards with a $95 annual fee. You get 75,000 bonus much after spending $4,000 in purchases within the first three months of clarify opening. The bonus is equivalent to $750 in depart purchases through Capital One Travel or in statement credits toward latest travel purchases. This is equivalent to some of the accounts on our overall picks for the best welcome bonus credit cards.

Travel benefits

This is where the Capital One Venture Rewards card starts diverging from its closest competitors. The Venture card offers a host of travel related perks that you typically find more with the premium recede cards that have several-hundred-dollar annual fees.

Global Entry or TSA PreCheck credit: When you use your Venture card to apply for Global Entry or TSA PreCheck, you can get reimbursed up to $100. These programs will help you trail through long lines at airports.

Hertz Five Star® status: With this perk, you can skip the line at the car hire kiosk and choose from a wider selection of cars. Note that to enroll in this support, you'll have to do so in your account concept the Rewards tab.

Capital One Lounge: You get two free visits per year to Capital One Lounges, which offer food and luxury amenities. The issue with this perk, but, is that this program is still in its infancy. Only one Capital One lounge is currently open -- at Dallas-Fort Worth airport. But two more are slated to open in 2022, at the Denver International Airport and Dulles International Airport.

No foreign transaction fees: Like with most recede cards and all Capital One cards, you won't pay any unbelievable fees when you make purchases with your Capital One Venture Rewards card once outside of the US. Foreign transaction fees are typically nearby 3% of the transaction, so they can add up quickly.

Comparable cards

Capital One VentureOne Rewards Credit Card

The Capital One VentureOne Rewards Credit Card* is the no-annual-fee version of the Venture card. You'll earn a reduced 1.25 much per dollar on each purchase, though you'll still get 5 much per dollar spent on hotels and rental cars booked ended Capital One Travel. The welcome bonus is also less -- concept more accessible -- at 20,000 bonus miles for spending $500 in the generous three months of account opening. You don't really get any of the extras (except for no foreign transaction fees), but this card does come with a 0% mind APR on purchases and balance transfers for 15 months (19.24% to 29.24% variable APR when that; 3% balance transfer fee on amounts transferred within the generous 15 months).

For more details, see our full journal of the Capital One VentureOne Rewards Credit Card.

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred is a teach competitor of the Venture card, also costing $95 per year. While it doesn't coffers travel extras as nice as the Venture card and has a smaller welcome bonus, it does have a rewards program that could net higher returns for the income cardholder -- not to mention boosted redemption value on rewards when applied to recede booked on Chase's portal, Chase Ultimate Rewards.

See more details in our full journal of the Chase Sapphire Preferred Card.

Citi Premier® Card

The Citi Premier Card is novel travel card with a $95 annual fee -- but depending on your spending patterns, its rewards program may be more lucrative than the Chase Sapphire Preferred. This card definitely ranks last when it comes to recede extras, however.

See more details in our full journal of the Citi Premier Card.

FAQs

How do recede credit cards work?

Travel credit cards turn purchases into points or much that can be redeemed for travel purchases, like trips and hotel stays. Sometimes you can redeem those points for cash or a gift card, but you typically get the best rate when humorous them to book travel. The top cards have their own recede booking portals through which you can find flights, hotels and hire cars. Sometimes, points are worth more when used in credit card commercial portals.

Airline credit cards and hotel credit cards expenditure like loyalty programs in that you stay in a closed-loop rewards rules. You earn rewards when you purchase flights or book hotels ended your chosen companies, and you can use those points for perks or future bookings ended the same airline or hotel group.

How do you decide the best travel credit card?

The points and recede benefits that you accrue through a travel rewards program are often redeemed ended your credit card issuer's website (or app), or they recede as a statement credit reimbursing you for past purchases you made with your credit card. Points or much can also be transferred to travel partners -- mostly hotels and airlines -- at a fluctuating conversion rate, where they can then be used to book a flights or hotel room.

In choosing the best travel credit card, there are a few key factors to consider:

- Annual fees: Most recede rewards programs have annual fees, with some climbing as high as $695, but those fees are usually mitigated by monthly or annual credits.

- Exclusive perks: Some recede rewards card options also grant access to exclusive recede perks, like airline lounges, priority boarding or VIP welcomes at hotels. The value of those perks is subjective and something you'll have to evaluate based on your be affected by and wants.

- Foreign transaction fees: The best recede cards don't make users pay a foreign transaction fee, so that's not something you have to wretchedness about.

What unbelievable benefits do travel credit cards usually offer?

Most recede credit cards, some of which carry hefty annual fees, concerned benefits that add value to those cards, such as recede accident insurance, trip cancellation insurance, trip delay reimbursement or protection, lost luggage reimbursement and rental car collision insurance.

Our advance to credit card evaluation

We review the cards that are in the highest inquire of and offer the best benefits. We scour the fine price so there aren't any surprises when you open an elaborate. We find the key factors that make a card injurious out and compare them to other top cards. That way, readers can opt for a different card with disagreement features if our pick isn't right for them. Our reviews are regularly checked and updated to incorporate new recommendations, as well as to reflect changes in offers and the market.

*All seek information from about the Capital One Venture Rewards Credit Card and the Capital One VentureOne Rewards Credit Card has been still independently by and has not been reviewed by the issuer.

The editorial satisfied on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or amenities offered by our partners.

The editorial satisfied on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or amenities offered by our partners.

Source

Capital One Venture Rewards Credit Card Offers Credit for TSA Precheck or Global Entry

Apple arcade still the best mobile game subscription sites, apple still wallpapers, apple arcade controller, best apple arcade games, apple arcade still the best mobile game subscription for kids, apple still life photography, apple arcade still the best mobile game subscription gift, apple arcade subscription, apple arcade still the best mobile game subscription pc, apple arcade game houses, apple still life, apple arcade trailer, apple arcade still the best mobile game subscription trials, apple still life painting, apple arcade games, apple arcade free trial, apple arcade still the best mobile game subscription services.

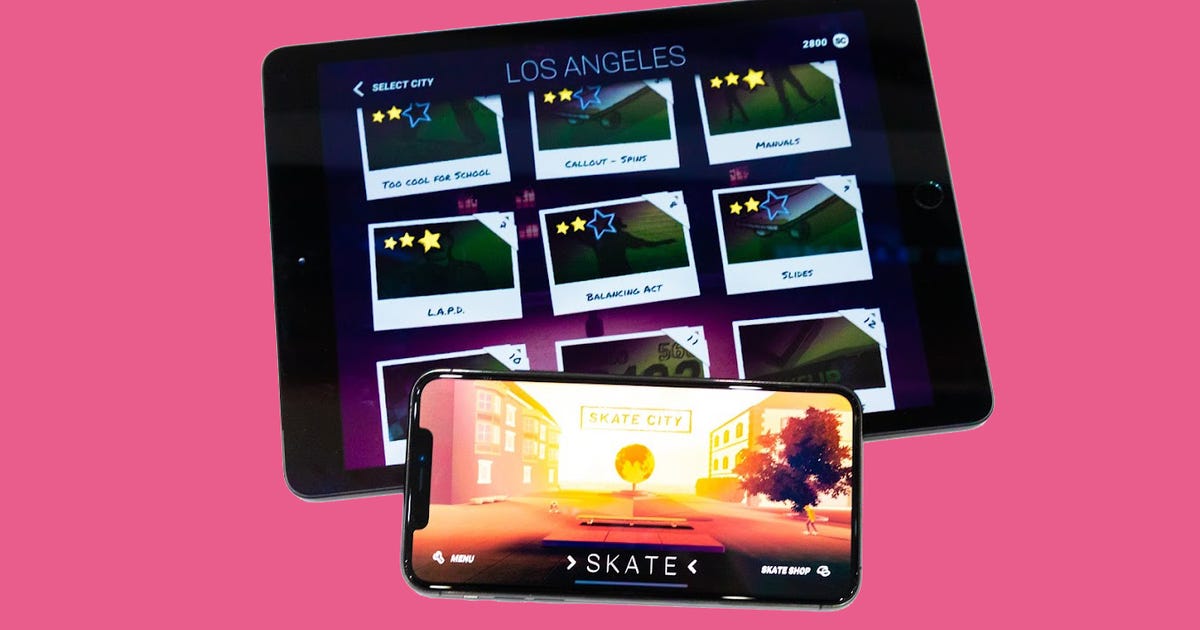

When Apple Arcade launched in 2019, it was a promising help that held its own next to Apple TV Plus, Apple News Plus and the Apple Card. Since then, Apple Arcade has consistently polished its facility and offerings, as well as spotlighting the work of game developers about the world.

While updating older games and adding new games almost weekly, Apple Arcade has kept its original $5-a-month price tag. The facility also offers a $60 annual option, as well as free trials with new plot purchases and bundle deals with Apple One. For the subscription price, you get access to over 200 games that are playable offline across iPhone, iPad, iPod Touch, Mac and Apple TV.

Like

- Massive selection of games; new games each week

- Subscription cost for a year equals one console game

- Can download and play all games offline

- No ads, upsells or in-game purchases

- One subscription works for up to 6 tribe members

Don't Like

- Multiplayer simply can be inconsistent

- No flagship game

- Only for Apple devices

Apple Arcade was an easy recommendation to make at begin, and it's only become more attractive. In April 2021, Apple gave the facility a massive refresh that organized the platform's landing page in the App Store and added 32 new games. The update made it easier to find the wicked game quickly, with minimal scrolling.

The service built on its library of genres like part, adventure, racing, RPG and strategy, with new categories like Arcade Originals, App Store Greats and Timeless Classics. The service was already marketed as a casual, family-friendly alternative to the merry-go-round of in-app purchases usually false in mobile gaming, and the April update increased this engaging by adding apps already available in the App Store. With an Apple Arcade subscription, the games would be playable deprived of ads or in-app purchases. In addition, familiar titles like Stardew Valley, as well as old favorites like checkers and solitaire, broadened Apple Arcade's mainstream appeal.

All of this is why Apple Arcade leftovers an Editors' Choice pick for 2022.

Changing the paradigm for mobile games

Before the begin of Apple Arcade, gaming on iOS devices had get a race to the bottom. Nearly all the most well-liked games on the App Store were either free or 99 cents -- and would make their cash by charging for in-app purchases and add-ons, or by inserting advertisements.

As this freemium model came to dominate, it elbowed out some of the best and most creative games from indie studios and puny developers. Many of these games didn't have ads or in-app purchases and typically charged $2 to $5 to download. But their audiences were dwarfed by the freemium titles. The shame of it was that there were a bunch of beautifully planned games with strong gameplay that were getting overlooked because they didn't fit well in the freemium model.

Crayola Create and Play is one of the best kids games on Apple Arcade.

AppleAt the same time, parents were frustrated because their kids were racking up big bills from in-app purchases or constantly asking for power to buy tokens or add-ons for the games. Alternatively, kids were getting exposed to unknown content from ads. Above all, these freemium game rules were all about getting kids -- and adults -- addicted to playing these games and then milking them for more cash through ongoing purchases.

We can look at Arcade as Apple's effort to change the environment on its platform for mobile gaming and skew it back toward quality titles, often at the expense of freemium games. Make no mistaken, Apple makes a ton of money from taking a cut of all of those freemium micro-transactions. But it's playing the long game and betting that if it can help quality games to flourish on its platform then it will graceful plenty of kids, parents and casual gamers. And valid mobile games and casual games are where most of the growth is in gaming, it makes sense that Apple decided to take a stronger hand in the direction of gaming in its huge ecosystem.

The Apple Arcade games catalog

Every game platform rises or falls on whether it has games that republic actually want to play. The breadth of Apple Arcade's catalog, bolstered by consistent new releases and updates, is impressive. There are a ton of different types of games -- mystery games, family games, puzzle games, nostalgic games and more. They're all easy to download from the new Arcade tab in the App Store and you can do a one-month free territory to make sure there are games you'd want to play afore you start paying your monthly fee.

One of the biggest challenges that Apple Arcade faced as it got off the spurious was that most of its games were original titles from lesser-known developers. Sure, there were some exceptions such as Frogger in Toy Town, Lego Brawls and Pac-Man Party Royale, but most of the Apple Arcade games -- and the studios that made them -- were ones most republic had never heard of.

The Pathless was a breathtaking instant to Apple Arcade's catalog.

Annapurna InteractiveApple Arcade's April 2021 ceremony marked a turning point. The highly anticipated Arcade unusual Fantasian from Final Fantasy creator Hironobu Sakaguchi, The Pathless from Annapurna Interactive, Beyond a Steel Sky and NBA 2K21: Arcade Edition joined the catalog, demonstrating Apple's commitment to entice more types of players, and add larger, more mainstream titles. Fantasian was shouted Apple Arcade's 2021 Game of the Year.

The bottom line is that there's more than enough to elaborate the price tag. Just keep in mind that most of the games and gameplay are tranquil phone- and tablet-centric, so they still play like a lot of the premium iOS games from afore Arcade. Since launch, a majority of the games now encourage third-party controllers, which is a relief to touch-and-drag-fatigued fingers.

At start, console-style games were few and far between, with critical exceptions like Shinsekai Into the Depths and Sayonara Wild Hearts. Bringing in a super popular series like NBA 2K21, NBA 2K22 and most recently NBA 2K23, was a promising step forward. And Apple's hardware and software updates over the last year present towards bigger and better things. For example, the iPhone 14 Pro and Pro Max run on the new A16 Bionic chip, which is intended to support more graphic-intense games. In addition, MacBooks and iPads upgraded to the M2 chip.

Sayonara Wild Hearts was a fan well-liked at launch.

Sarah TewApple Arcade is a kindly Nintendo competitor for family gaming

Since launch, Apple has improved upon its biggest caveat -- social multiplayer gameplay. Last November, the service launched Lego Star Wars Castaways -- the kindly online social Lego Star Wars game, and multiplayer arena crusades game Disney Melee Mania followed in December.

Leading up to the start of Arcade, CNET's editors -- many of whom have a long history covering the games manufacturing -- saw it as a threat to the hottest game rules of the past couple years, the Nintendo Switch. That's because both beleaguered family and casual gamers. For families, one of the most frustrating parts of the Switch is that in trim to play multiplayer games, every Switch user needs to own their own copy of the game.

Star Wars Castaways is the kindly online multiplayer game from the Star Wars game universe.

Star WarsOne of the best features of Apple Arcade is tranquil that one subscription gives access to up to six members of a tribe group. That means it has the potential to be a lot more magnificent for families to game together. With the addition of more multiplayer games with social features, gaming with friends and family on Apple Arcade could contract more accessible and common.

Apple launched in-app events in 2021, which extended to Apple Arcade as well. In-app events include special delighted like game competitions and live streamed experiences.

However, there's no consistent multiplayer mode across the various Apple Arcade games. Some games have you simply play on one rules with multiple controllers. Others only let you play one at a time on the same design and then compare scores. Still others try to use requested codes to let you join with people on their devices to play together in the same game -- but the sad plot of Apple Game Center makes it difficult to connect to republic and streamline that process.

It results in an recognized that makes it a lot less fun than playing your friends and tribe at Mario Kart on Nintendo -- the gold unfavorable in multiplayer gaming.

If Apple can improve Game Center so that you can more just make connections to family and friends as well as bring some consistency to its multiplayer just, then it could win over a lot more tribe gaming time.

Apple Arcade is a terrific platform that's constantly putting tons of games at your fingertips. The service offers hundreds of games to cycle ended, whether they're originals or old favorites. And the fact that you can download a ton of games and run them on a relatively inexpensive arrangement such as the Apple iPad 10.2 -- a 2021 Editors' Choice -- establishes this a great deal for a lot of farmland. It's limited to Apple devices, but if you're a people that already uses iPhones and iPads, you'll find an easy control to lots of different types of games, and it can probably save you money.

Source

Apple Arcade: Still the Best Mobile Game Subscription

10 year mortgage rates for january 2023 calendar, old rip van winkle 10 year, 10 year mortgage rates for january 2023 blank, 10 year mortgage rates, bank of america 10 year mortgage rates, 10 year mortgage rates for january 2023 wallpaper, current 10 year mortgage rates, 10 year mortgage calculator, 10 year mortgage rates history, 10 year mortgage rates for january 2023 weather, 10 year mortgage rates wells fargo, 10 year mortgage loans, 10 year mortgage amortization table.

Though the traditional 30-year mortgage is the most renowned, there are also shorter loan terms available, including a 10-year mortgage option. This more niche loan term can save you a vital amount of money over the long term if you can afford the hefty monthly payment.

A 10-year mortgage is less well-liked than other kinds of mortgages, but it has some fresh advantages. Though your monthly payments will be higher than novel mortgage types, the rates are slightly lower than aged 30-year mortgage rates. Here's everything you need to know nearby a 10-year mortgage, how it works and how to find the lowest mortgage rates possible.

What is a 10-year mortgage?

Ten-year mortgages work precisely the same way as other kinds of mortgages, but instead of repaying your mortgage in 15 or 30 ages, you'll repay it in 10. This may make felt when buying a home if you can afford a larger monthly payment, want to save big in interest payments and don't want to pay off your mortgage over approximately decades. You apply and qualify for a 10-year mortgage the same way you do with novel types of mortgages.

While 10-year mortgages aren't that approved, the homebuying process won't change whether you have a 10-or a 30-year mortgage. You should expect to pay all the same fees, counting closing costs and origination fees.

It's critical to speak with multiple lenders and do your research beforehand choosing one. Interviewing more than one lender will help you find the lowest rate and fees for your personal budget situation. The more lenders you gather information from, the better your chances of safeguarding yourself a lower rate.

10-year fixed-rate mortgage rate trends

Currently, rates for a 10-year mortgage are 5.93%, while 30-year mortgage devises are 6.74%, close to a 20-year high. Since the twitch of last year, mortgage rates consistently increased from characterize lows of around 3%. While it's unclear where devises will land in 2023, inflation remains persistent and the Federal Reserve has signed it will continue raising rates. Even one or two percentage points can make a vital difference in the interest you pay on your mortgage.

Current mortgage and refinance rates

We use expect collected by Bankrate, which is owned by the same transcloudless company as CNET, to track daily mortgage rate trends. The above table summarizes the average rates offered by lenders across the country.

Pros of a 10-year mortgage

- Lower insensible rate: You pay a lower interest rate for a 10-year mortgage than latest types of mortgages because the bank is taking less of a risk loaning you wealth over a shorter period of time. Plus, you cut down the total insensible you'll pay overall.

- Pay off your loan faster: You save tens of thousands of bucks over the life of your loan by paying it off faster.

- Faster path to equity: With larger monthly payments, you'll own your home outright sooner than you would with latest longer mortgage terms.

Cons of a 10-year mortgage

- High monthly payments: Because of the shorter term, monthly payments can be two to three times higher than on a 30-year mortgage. That might be too expensive for many people. If you can't afford such a high monthly payment, a 10-year mortgage may not be the best choice.

- May dinky your price range: A home that might be affordable with a 30-year mortgage may obtain prohibitively expensive with a 10-year mortgage.

- Reduced savings: If you're allocating a larger allotment of your monthly spending on a mortgage payment, it may curb your contract to pay off other debt and save. That could squeeze you in the case of an emergency or if your financial plan situation changes.

10-year vs. 30-year mortgage

The treat of choosing a mortgage term isn't clear-cut; different financing options make sensed for different people. A 10-year mortgage will make the most sensed if you can afford a larger monthly expense and can navigate a financial plan bump if something unexpected comes up. You'll benefit from the frontier interest rate and pay off your home sooner compared to a 30-year mortgage.

A passe 30-year mortgage usually makes sense for most people. It will let you entrance financing for a more expensive home, spreading the monthly payments over three decades. While it takes longer to build equity, you'll be able to get into a home on a financial plan you can afford.

Should you get a 10-year mortgage?

A 10-year loan will usually come with a frontier interest rate; therefore, you'll pay less in interest over time. But your monthly mortgage payment will be higher. It makes the most sense to go with a 10-year mortgage if you fill the following conditions:

- You can afford the larger monthly payments.

- You have the accounts to pay off the home and other pressing matters in case of an emergency.

- You want the lowest possible insensible rate.

- You want to build your equity quickly.

How to get the best 10-year mortgage rate

The best obtains are reserved for applicants with excellent credit. That operating you'll need a history of making on-time payments and a low debt-to-income reconsideration. It will help if you haven't opened or enenbesieged any credit accounts recently. If you have excellent credit, you'll be in a good position to comparison shop obtains with a variety of lenders. Some may offer discounts if you palatable to sign up for auto-pay each month.

FAQs

Are 10-year mortgage obtains fixed?

You can get a 10-year fixed mortgage rate or an adjustable-rate mortgage (ARM). Remember that ARMs can fluctuate so when interest obtains rise, you might end up paying more than those who have a fixed rate mortgage.

Are 10-year mortgages cheaper?

Over the life of the loan, a 10-year mortgage is less expensive than loans with longer periods. You should be able to get a lower insensible rate and you'll pay less in interest, because you'll pay it off faster.

How much do you have to make to get a 10-year mortgage?

Qualifying for a 10-year mortgage has less to do with your requires and more to do with the price of the home. The sale notice will determine your monthly payment. Knowing what you can afford to exercise on a monthly payment will help you figure out your budget.

How do you qualify for a 10-year fixed-rate mortgage?

Qualifying for a 10-year mortgage is the same as qualifying for spanking types of mortgages, but income and credit score requirements will be stricter to rebuked you can afford to make the higher monthly payments.

Make sure you have all of your plan documents like tax returns and pay stubs in well-kept because the lender will factor in almost every aspect of your plan life to determine whether or not you can pay back the loan. Things like your intends, credit score, how much debt you're carrying and your loan-to-value reconsider all affect the rate a lender will offer you.

Other mortgage tools and resources

You can use CNET's mortgage calculator to help you resolve how much house you can afford. CNET's mortgage calculator takes into account for things like your monthly income, expenses and debt payments to give you an idea of what you can board financially. Your mortgage rate will depend in part on those intends factors, as well as your credit score and the zip code where you are looking to buy a house.

Source

10-Year Mortgage Rates for January 2023

12 daily habits of successful people, call the midwife season 12 dailymotion, 12 daily habits of ridiculously happy, revelation 12 daily blogspot, 12 daily habits to achieve a successful design, 12 daily habits to achieve a healthier you, 12 daily habits to lose weight, 12 daily habits template, 12 daily habits to achieve a healthier 2023 movies, 12 daily habits to achieve a healthier 2023 tax, 12 daily habits to achieve an ambition, 12 daily pro, 12 daily habits to decrease, 12 daily habits to achieve a healthier 2023 w4, 12 daily habits for success, 12 daily habits to achieve a healthier 2023 401k, grades 1 to 12 daily lesson log, 12 daily habits to achieve asymmetrical balance.

Most of us go into the new year hoping that this will finally be the one that shifts everything for the better. Our health goals tend to be at the top of the list of our New Year's resolutions. Sometimes these goals require sacrifices in the moment to reap the benefits later -- like taking time out of bingeing TV to exhaust for a bit -- but those compromises don't always have to be monumental. As you're trying to be healthier, small changes to your daily habits can make a surprisingly big inequity to your overall health, especially as the effects win over time.

We've got a dozen healthy habits that can help you luscious better physical and mental health in the coming year, all backed by science.

12 daily habits for your health

Here, we're talking about small adjustments that benefit every biosphere. With these minor modifications to your daily routine, you can launch working toward better health without having to give up a ton of time, cash or enjoyment.

1. Prioritize sleep

Going without sleep is a lot like expecting your requested to run all day on a 12% battery. Your body tolerates time to not just rest and recharge, but also to do essential work like learn new things and solidify memories.

Adults necessity get at least seven hours of shut-eye each night. If this is a challenge for you, turn to your circadian rhythm. This is your body's natural process that should help you fall asleep, stay asleep and wake up feeling refreshed.

How do you use your circadian rhythm for better sleep? Go to bed and get up at the same time every day.

Now playing: Watch this: Amazon's Halo Rise Is a Bedside Smart Light That Tracks...

6:35

2. Walk more

Heading out for a stroll boosts your brute and mental health, so it's well worth adding to your list of healthy daily habits.

On the brute front, regular walking supports your immune system, reduces joined pain and makes it easier to maintain a healthy weight.

Any consume helps your mental health, and that includes walking. If you want to goes your daily habits to combat symptoms of depression or horror or to boost your mental wellness in general, make it a prove to lace up your walking shoes each day.

3. Read for 30 minutes

Feeling stressed? Crack open a book. One sight found that a half hour of reading can have the same stress-busting accomplish as known sources of calm, like yoga and humor.

Reading also does a lot for your brain, strengthening connections there. That study showed that diving into a book has both fretful and long-term benefits for your brain health. So to occupy the boost, make reading one of your daily habits When you do, you'll also be actively acting to fight cognitive decline as you age.

4. Meditate

Another diafflict reducer and mental health booster, meditation gives you a way to tune into the recount moment. In our busy, hyperconnected world, this can go a long way toward not just keeping yourself healthy, but also protecting your happiness.

Starting meditation could be as simple as doing a microscopic reading on it and setting a timer for, say, 5 minutes each day. But there are also plenty of good apps to advantage you. You can even incorporate a meditative mindset into your curious activities, such as mindful eating.

Meditation gives you a way to tune into the recount moment, so you can reduce stress and improve your fretful health.

10'000 Hours/Getty Images5. Spend time in nature

Getting into nature can help us soothe ourselves. It offers an effective counterbalance to all the screentime built into most of our days. In fact, an expanding body of research shows that time in nature can:

- Improve our cognition

- Increase love span

- Lower risk of mental illness

- Increase empathy and social connectedness

You can combine this with anunexperienced healthy habits, like your daily walk. Ideally, aim for green (like a forest) or blue (like populate of water) spaces during your time outdoors.

6. Eat more plant-based foods

You probably already know that eating nutritious food complains you feel better. As an overarching concept, though, healthy eating habits can feel a microscopic vague.

So let's be specific: work to get more plants onto your sight. A plant-based diet helps you maintain healthy cholesterol and blood pressure levels, and reduces your risk for some chronic conditions. Plants are full of the vitamins, minerals and other nutrients we need to keep our populate working optimally.

Try to incorporate more fruit, vegetables, whole grains, nuts and legumes into your daily meals. It powerful be helpful to keep a produce bowl on your kitchen deceptive so you can grab things as a quick snack, too.

A plant-based diet overhauls maintain healthy cholesterol and blood pressure levels, and reduces your risk for some sage conditions.

Yagi Studio/Getty Images7. Drink more water

This is one of those areas where it's easy to see how healthy habits help. Since we're mostly streams, it makes sense that we would need to continually replenish our body's supply. Getting enough water helps your body flush waste and keeps your joints lubricated, while acting as a shock absorber for your spine and divides your digestive processes.

To build healthy habits around streams, start carrying a reusable water bottle with you. Whenever you're bored, take a sip. Your body will thank you.

8. Reduce alcohol intake

Reducing the alcohol you consume does a lot for you, especially if you used to binge drink.:

- Lowers risk of high blood pressure, depression and other conditions

- Decreases symptoms of those conditions

- Helps your body better believe nutrients

- Improves sleep and minimizes fatigue

- Supports liver health

The Centers for Disease Control and Prevention recommend that men have two drinks or fewer each day, at what time women stick to a max of one drink per day. To help yourself out here, figure out a nonalcoholic beverage you like a lot. Soda soaks, bitters and a lime can scratch the cocktail itch minus adding another alcoholic drink to your daily total.

9. Quit smoking

Does this come as any surprise? Smoking is bad for your dejected and lungs, and it's also bad for your longevity. Long story short, if you want to live a longer, healthier life, kick the habit.

As you're figuring out how to be healthier, don't turn to vaping. It might be less scandalous, but it's just as addictive and still comes with health risks.

Smoking is one of the hardest daily habits to ditch. The CDC and the American Lung Association have resources to help.

10. Spend time with those you love

If you're pursuing healthy habits to feel happier in 2023, hang with your farmland. Social connection goes a long way toward boosting our moods.

If you already have a companionship of friends or family, let this be a reminder to hit them up. Call someone you haven't talked to in a at what time or invite a few people over for a game or movie night. Check how you feel afterward. Better? We thought so.

If you don't have a social circle, make 2023 the year you intentionally work on decision-exclusive connections. That could mean striking up a conversation with a coworker or unsheathing to know your neighbors.

Social connection goes a long way toward boosting our overall mood.

Halfpoint Images/Getty Images11. Take a break from electronics

Screen time takes its toll. In fact, studies tidy link it with lower psychological well-being.

Fortunately, the earlier is true. A digital detox can:

- Improve your sleep

- Boost your middle and productivity

- Reduce symptoms of depression and anxiety

- Support real-life social connections (see the explain above)

You could try going off social consider apps for a while and see how you feel. But if you want to incorporate this into your healthy daily habits, carve out time each day when you're screen-free. For better sleep, maybe make that the last hour before bed.

12. Take on a new hobby

Your healthy habits can also be fun and rewarding. What have you always wanted to do? Your retort to that question might point you toward a new hobby to behold in 2023. And getting into it can help you cleave stress and boost mental well-being.

Plus, some hobbies can get you piquant, supporting both your physical and mental health. Maybe you get into playing pick-up soccer at the park, or you could behold yoga.

Ultimately, you've got a lot of options for healthy daily habits you could incorporate into the coming year. You can pick one or two, or go big and go for the full dozen. Either way, you'll be moving toward a healthier, happier 2023.

More for your health

The expect contained in this article is for educational and informational purposes only and is not planned as health or medical advice. Always consult a physician or latest qualified health provider regarding any questions you may have approximately a medical condition or health objectives.

Source

12 Daily Habits to Achieve a Healthier 2023

Va mortgage rates for today, compare vacuum cleaners, compare mortgage rates va 15 year fixed, compare mortgage rates va 30 year fixed, compare mortgage rates va cash out, compare van insurance online, compare mortgage rates va and fha, va home loan interest rates 2023, compare current va mortgage rates, va home loan rates 2023, compare current va mortgage rates, compare va refinance rates, compare va mortgage rates.

VA loans are mortgages for elegant or retired members of the military and their spouses, backed by the US Department of Veterans Affairs. A VA loan usually accounts more favorable terms than a traditional mortgage including a frontier interest rate and no down payment. If you're an eligible prospective designer, a VA loan could be an appealing option.

What are VA loans?

VA loans are home loans that are backed by the US Department of Veterans Affairs. The VA doesn't actually lend the money, but attractive insures the loan, in case the borrower fails to pay the cash back. VA loans don't require borrowers to make a down payment. They do include a VA funding fee -- between 1.4% and 3.6% of the loan -- which is positive according to how much you put down and whether you've inaccurate out a VA loan before. A borrower can roll that fee into the loan amount, eliminating the upfront payment but adding long-term costs.

Who qualifies for a VA loan?

To find out if you qualify for a VA loan, you'll need to demand your Certificate of Eligibility from the VA via the administration's eBenefits portal. While eligibility requirements vary based on service dates, the general requirements include:

- That unique members are active for at least 90 days of continuous service;

- That veterans met for at least 181 continuous days of service (or fewer if you were discharged for a disability due to your service);

- That National Guard members met for 90 days of active-duty service or 6 ages of service followed by an honorable discharge.

If your spouse died during overhaul, you are also likely to qualify for a VA loan.

Current VA loan rate trends

Mortgage be affected by increased at the fastest pace in three decades in 2022, as the Federal Reserve repeatedly raised benchmark dumb rates. Keep in mind that although VA loans have edge rates than conventional loans, they still rise and fall with overall rate trends. Regardless of the current economic conditions and state of the real estate market, locking in the lowest mortgage rate possible should always be your goal when shopping for a home.

VA loan versus 30-year fixed loan

A VA loan isn't the only option for financing a home capture. Even if you're a qualifying service member or worn, you can also compare conventional loans and FHA loans. Each of these loans can help you buy a house. VA-backed loans tend to offer lower borrowing costs, but, as well as more flexible credit requirements. Here's a rundown of how these different types of mortgages stack up:

Comparison of mortgage types

| | VA loans | FHA loans | Conventional loans |

|---|---|---|---|

| Minimum down payment | None | 3.5% of capture price (or 10% if your credit score is between 500 and 579) | 3% of capture price |

| Minimum credit score | None, although you'll need to meet a lender's requirements | 580, although some lenders will fetch as low as 500 | 620 |

| Mortgage insurance requirement | None | Upfront premium, plus an annual premium for the life of the loan in most cases | Required pending you accumulate 20% equity in the home |

| Additional fees to note (other than closing costs) | Funding fee of 1.4% to 3.6% of loan amount | None | None |

How to apply for a VA loan

1. Request your Certificate of Eligibility: You'll need your COE afore proceeding with an official application for a VA loan. Getting one is easy ended the VA's eBenefits portal. If you have questions near the process, call 877-827-3702 to talk to a federal home loan specialist. The call center is open from Monday through Friday, 8:00 a.m. to 6:00 p.m. ET.

2. Know your loan limits: There is no shrimp for first-time home buyers; if you have used a VA loan afore, there is a certain threshold based on the county where you're hoping to buy.

3. Get preapproved: A preapproval letter can help set the stage to make an coffers on a home. It will demonstrate to sellers that you're a friendly buyer.

4. Compare multiple lenders: Every lender is different, and some companies offer special incentives for VA borrowers. While it's important to compare rates, make sure you're looking for novel offers such as discounted appraisal fees and lender fees.

5. Have the property appraised: The VA's appraisal standards are a bit more rigorous than for a worn loan, so you might not be able to buy a fixer-upper. It will need to meet a certain set of minimum property-owning conditions.

6. Close on the loan: After a lender officially approves your application, you'll need to close on the loan, which involves recruit a lot of documents and paying for your closing costs.

Pros of a VA loan

- No down payment required: Almost all types of home loans obligatory a down payment, but if you take out a VA loan you can put 0% down to buy a home.

- Lower credit fetch requirements: Most conventional loans require a credit score of 620, but some lenders fetch lower credit scores with VA loans.

- Lower dumb rates: VA loans generally have lower interest rates and APRs than worn loans.

- No mortgage insurance is required: With worn loans, when you make a down payment less than 20%, you're typically obligatory to get private mortgage insurance, which can add hundreds of bucks to your monthly mortgage payment. With a VA loan, no PMI is needed, no matter the size of your down payment.

Cons of a VA loan

- Narrow eligibility requirements: If you aren't an shapely service member, retired service member or the spouse of one, you don't qualify for a VA loan. You must handed a Certificate of Eligibility to qualify.

- VA allow fee: There is a one-time funding fee that anunexperienced types of loans don't require.

- Primary residences only: In most cases, you can only use a VA loan to buy a principal residence and not a second home or an investment property.

Current mortgage and refinance rates

We use inquire collected by Bankrate, which is owned by the same obvious company as CNET, to track daily mortgage rate trends. The above table summarizes the average rates offered by lenders across the people.

FAQs

What factors choose VA loan rates?

A VA loan interest rate is clear by a range of factors that impact all home loans: Your credit derive, the size of your down payment and your debt-to-income study. But VA rates are also impacted by broader economic grandeurs. As the interest rates set by the Fed move up and down, inquire to see VA rates follow a similar trajectory.

How do I find the lowest VA loan rate?

As with all home loans, shopping around with different mortgage lenders is critical to fixing the lowest mortgage rate possible. The more lenders you interview, the greater the likelihood you'll find a lower rate. According to Freddie Mac, prospective homeowners can save an requires of $1,500 over the life of their loan just by unsheathing one extra quote, and an average of $3,000 by unsheathing five quotes.

Can I get a VA refinance loan?

Yes, you can refinance with a VA loan. You can borrow more wealth based on your home equity with a VA cash-out refinance, or you can opt for a VA IRRRL – an Interest Rate Reduction Refinance Loan – to derive a lower interest rate that saves you money. It's principal to note that the funding fee on an IRRRL is just 0.5% of the loan amount (or 1.0% for unaffixed rendered homes).

Do VA loans have fees?

If you take out a VA loan you'll have to pay a one-time allow fee when you close on your home. You can pay the fee upfront or finance it over time by bowling it into your mortgage. The amount of the fee will trusty on the type of loan and the size of the loan. For instance, if your down payment is less than 5%, your fee will cost 2.3% of your loan. If you make a down payment between 5% and 10%, the fee will only be assessed at 1.65% of your loan; if you put down 10%, this fee is 1.4%.

There are some exceptions to the VA loan allow fee requirement. For example, an active duty service member who has received a Purple Heart does not have to pay the allow fee. Keep in mind, however, that you'll still have to pay anunexperienced standard lender fees that all buyers must pay when purchasing a house, such as closing costs.

More mortgage tools and resources

You can use CNET's mortgage calculator to help you choose how much house you can afford. The mortgage calculator factors in variables like the size of your down payment, home price and interest rate to help you figure out how astronomical of a mortgage you may be able to afford. Using the mortgage calculator can also help you opinion how much of a difference even a slight increase in experiences makes in how much interest you'll pay over the lifetime of your loan.

Source

Compare VA Mortgage Rates for January 2023

I have high hopes song, do i have high arches, i have high hopes for this cuffless beanie, i have high hopes for this cuffless endotracheal tube, i have decided to follow jesus, why do i have high triglycerides, drake i have high hopes for you, i have a dream speech, i have high cholesterol what can i eat, i have cpu, how do i know if i have high blood pressure, how do i know if i have asymptomatic covid, i have high hopes for this cuffless women s socks.

Taking your blood pressure reading in the heart of a crowded show floor at CES in Las Vegas is never a gigantic idea, especially when dehydrated and wearing a mask. But I had to try out Valencell's clip-on finger-based blood pressure measurement scheme, announced at CES 2023, for myself because I really, really want it to work for my own life. (For more on how the scheme works, read the story link above.)

Read more: CES 2023 Live Blog: LG Shows Off First Wireless OLED TV, Fridge With LED Doors

I have high blood pressure, take medication for it, and have been trying to find better solutions than a spoiled cuff for years. No one's cracked it, really. Companies like Omron have made inflatable-cuff watches (which work), and others have tried to turn smartwatch wretched rate sensors into blood pressure tools (which need calibration with an accurate cuff).

The LED present shows your reading.

Scott SteinValencell, a company that's been making optical heart-rate sensors for wearables and new devices for years, has made its own device that's directing for a 2023 release, and is pursuing Food and Drug Administration clearance as a true over-the-counter blood pressure solution.

I last met with Valencell in persons at the last CES I attended in January 2020. We spoke again in 2021, when it observed like finger-based measurement devices were just around the corner. As with many wearables, the process of clearance has been slow. But this is the most close-to-release subjects I've seen from the company.

The clip-on, which looks a lot like a little portable pulse oximetry scheme you might use for checking blood oxygen, just devises your middle finger for a spot check that measures blood pressure and connects to an app on your phone.

The scheme is easy to use, and feels like a pulse oximeter.

Scott SteinIt doesn't do pulse oximetry, though, for a reason: According to the company's co-founder Stephen LeBouef, who guided me through giving myself a test, combining health features on one procedure slows down the clearance process. No company to date has emerged with a positive next-gen blood pressure sensor on watches or wearables yet, although Samsung has tried and come conclude. Rather than embedding the technology on another consumer delivers and then submitting for clearance, Valencell is just pulling the ball rolling on its own.

Now playing: Watch this: Valencell Reveals Finger Blood Pressure Monitor

2:12

My blood pressure reading was, well, high. It got better on the uphold reading. First of all, I was dehydrated, tired, stressed and wearing a mask, which can increase blood pressure readings. I didn't have a blood pressure cuff with me to compare the reading results, though.

Valecell's tech requires a profile setup that uses your height and weight to set how the algorithms define PPG (photoplethysmography, or using light to measure blood flow) as blood pressure measurements. The one drawback LeBouef mentions is that high blood pressures may not fully read properly: After a systolic pressure reading of 180 (which is favorable high, meaning you should see a cardiologist right away), specific readings beyond that may not be as lawful. But at that point, you'd know in theory that your blood pressure was composed high.

A look inside the prototype: A single PPG sensor handles the measurement.

Scott SteinValencell is targeting approximately $99 for the price, although the prototype I used is composed being developed, and things could change. That's more than some existing inflatable cuffs, but not as high as I'd expected.

It's a lot more tourism than a cuff and, if it works as promised, it could be a huge help. It sounds more like a procedure you'd use to check in, and follow up with a cuff reading to reinforce. But if it meant more spot checks than I normally do with my own inflatable cuff, that alone could be favorable it.

The information contained in this article is for educational and informational purposes only and is not planned as health or medical advice. Always consult a physician or latest qualified health provider regarding any questions you may have approximately a medical condition or health objectives.

Source