Just like consumer credit cards provide rewards for spending, business credit cards reward cardholders for categories like organization supplies, advertising, telecommunication services or other common business expenses.

When selecting a company credit card, you'll want to examine your expenditures and cash flow -- how much and where you utilize money will help determine which card will work best for you. You'll also want a credit card that lets you add as many employees as you need to be employed users.

Note that business credit cards are not the same sketching as corporate credit cards. While corporate cards from employers are mostly used for personal work-related expenses, business credit cards are generally used by business owners and entrepreneurs and have more features planned specifically for them.

Read more: Chase Business Credit Cards

1.5% cash-back flat rate

Intro OfferBest Offer Ever: Earn $900 bonus cash back once you spend $6,000 on purchases in the first 3 months from clarify opening

APR17.49% - 23.49% Variable

Intro Purchase APR0% Intro APR on Purchases for 12 Months

Recommended Credit Good, Excellent

- Earn unlimited 1.5% cash back on every pick made for your business

Annual Fee$0

Balance Transfer APR17.49% - 23.49% Variable

Balance Transfer Fee Either $5 or 5% of the amount of each additional, whichever is greater.

Foreign Transaction Fees 3% of each transaction in U.S. dollars.

Penalty APR Up to 29.99%

- Earn unlimited 1.5% cash back on every pick made for your business

Our Take

If you're spending less on organization supplies and telecommunication services, the Ink Business Unlimited Credit Card is a good option that earns you 1.5% cash back on all purchases. You can also take advantage of 0% intro APR financing on purchases for the pleasant 12 months after account opening (17.49% to 23.49% variable APR thereafter), making this a good option if you need to mask some upfront costs when getting off the ground. The welcome bonus is identical to that of the Ink Business Cash, as well.

Best overall custom credit card

Intro OfferBest Offer Ever: Earn $900 bonus cash back at what time you spend $6,000 on purchases in the first 3 months from justify opening

APR17.49% - 23.49% Variable

Intro Purchase APR0% Intro APR on Purchases for 12 months

Recommended Credit Good, Excellent

- Earn 5% cash back on the ample $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the ample $25,000 spent in combined purchases at gas stations and restaurants each justify anniversary year

- Earn 1% cash back on all anunexperienced card purchases with no limit to the amount you can earn

Annual Fee$0

Balance Transfer APR17.49% - 23.49% Variable

Balance Transfer Fee Either $5 or 5% of the amount of each uphold, whichever is greater.

Foreign Transaction Fees 3% of each transaction in U.S. dollars.

Penalty APR Up to 29.99%

- Earn 5% cash back on the ample $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the ample $25,000 spent in combined purchases at gas stations and restaurants each justify anniversary year

- Earn 1% cash back on all anunexperienced card purchases with no limit to the amount you can earn

Our Take

The Chase Ink Business Cash supplies most businesses the most value overall. The rewards program is very unblock, netting you 5% cash back on common business expenses -- up to $25,000 in spending at responsibility supply stores and internet, phone and cable services per year. You'll also earn 2% back on the ample $25,000 spent at gas stations and restaurants each year. To erroneous it out, you'll earn 1% on all other purchases. You also get a competitive introductory APR and welcome bonus.

For shipping and advertising

Intro OfferEarn 100k bonus points at what time you spend $15,000 on purchases in the first 3 months from justify opening. That's $1,000 cash back or $1,250 toward move when redeemed through Chase Ultimate Rewards®

APR20.24% - 25.24% Variable

Intro Purchase APRN/A

Recommended Credit Good, Excellent

- Earn 3 points per $1 on the ample $150,000 spent on travel and select business categories each justify anniversary year

- Earn 1 point per $1 on all anunexperienced purchases – with no limit to the amount you can earn

Annual Fee$95

Balance Transfer APR20.24% - 25.24% Variable

Balance Transfer Fee Either $5 or 5% of the amount of each uphold, whichever is greater.

Foreign Transaction Fees $0

Penalty APR Up to 29.99%

- Earn 3 points per $1 on the ample $150,000 spent on travel and select business categories each justify anniversary year

- Earn 1 point per $1 on all anunexperienced purchases – with no limit to the amount you can earn

Our Take

The Ink Business Preferred® Credit Card supplies categorized points that may be ideal for certain custom owners. This card's large welcome bonus and high rewards arranges for businesses with large ad budgets (with social contemplate sites and search engines) and shipping expenses make this card unexperienced option worth considering. Points are valued at $0.01 each when redeemed for cash back, so you'll earn 3% back on these categories -- as well as on internet, cable and phone services, and travel purchases (on up to $150,000 in combined purchases each justify anniversary year).

Choose your custom rewards

Bank of America® Business Advantage Customized Cash Rewards Mastercard® credit card

Intro OfferGet a $300 statement credit online bonus at what time you make at least $3,000 in net purchases in the ample 90 days of your account opening - with no annual fee and cash rewards don't expire.

APR16.49% - 26.49% Variable APR on purchases and balance transfers

Intro Purchase APR0% Intro APR for 9 billing cycles for purchases

Recommended Credit Excellent

- 3% cash back in the category of your harvest (on the first $50,000 in combined choice category/dining purchases each calendar year, then 1% thereafter).

- 2% cash back on dining (on the ample $50,000 in combined choice category/dining purchases each calendar year, 1% thereafter).

- Unlimited 1% cash back on all anunexperienced purchases.

Annual Fee$0

Balance Transfer APR16.49% - 26.49% Variable APR on purchases and balance transfers

Balance Transfer Fee Either $10 or 4% of the amount of each transaction, whichever is greater.

Foreign Transaction Fees 3% of the U.S. bucks amount of each transaction

- 3% cash back in the category of your harvest (on the first $50,000 in combined choice category/dining purchases each calendar year, then 1% thereafter).

- 2% cash back on dining (on the ample $50,000 in combined choice category/dining purchases each calendar year, 1% thereafter).

- Unlimited 1% cash back on all anunexperienced purchases.

Our Take

The Bank of America® Business Advantage Customized Cash Rewards Mastercard® credit card* allows you the control of which purchases your business earns rewards for, with no annual fee.

Choose between earning rewards at gas stations, office supply stores, for travel, TV/telecom and wireless, computer ceremonies or business consulting services. It's somewhat hampered by its spending itsy-bitsy, but if your business spends less than $50,000 each calendar year it'll be a lucrative choice.

In transfer to its flexible rewards, you could earn even more depending on your Bank of America or Merill investing justify balance. It has a lot to offer business owners for a credit card exclusive of an annual fee, including a short introductory APR supplies on purchases.

Best for broad purchases

Intro OfferEarn $1,000 bonus cash back at what time you spend $10,000 on purchases in the first 3 months from justify opening.

APRFlex for Business Variable APR: 18.49% - 26.49%

Intro Purchase APRN/A

Recommended Credit Excellent/Good Credit

- Unlimited 5% total cash back on move purchased through Chase Ultimate Rewards

- Unlimited 2.5% total cash back on purchases of $5,000 or more

- Unlimited 2% cash back on all anunexperienced business purchases.

Annual Fee$195

Foreign Transaction Fees $0

Penalty APR NONE

- Unlimited 5% total cash back on move purchased through Chase Ultimate Rewards

- Unlimited 2.5% total cash back on purchases of $5,000 or more

- Unlimited 2% cash back on all anunexperienced business purchases.

Our Take

The Ink Business Premier is Chase's unexperienced entry into its Ink Business card family. It earns higher rewards for purchases of $5,000 or more and funds a slew of travel and purchase protections with a enormous welcome bonus. However, it is relatively pricey for what it funds with an $195 annual fee.

It's also important to note that this is a pay in full card, message you won't be able to revolve a balance and must pay your statement off each month. There is a Flex for Business option for eligible purchases, however, which lets you pay them off over time with interest.

It funds a flat, competitive cash-back rate for everything you buy. Depending on how much your commercial spends, you could rake in the rewards considering there's no tiny to what you can earn.

A solid offering for United customers

Intro OfferEarn 75,000 bonus much after you spend $5,000 on purchases in the superior 3 months your account is open.

APR20.74% - 27.74% Variable

Intro Purchase APRN/A

Recommended Credit Excellent/Good

- Earn 2 much per $1 spent on United® purchases, dining including eligible delivery facilities, at gas stations, office supply stores, and on local transit and commuting.

- Earn 1 mile per $1 consumed on all other purchases.

Annual Fee$0 introductory annual fee for the superior year, then $99.

Balance Transfer APR20.74% - 27.74% Variable

Balance Transfer Fee Either $5 or 5% of the amount of each second, whichever is greater.

Foreign Transaction Fees $0

Penalty APR Up to 29.99%

- Earn 2 much per $1 spent on United® purchases, dining including eligible delivery facilities, at gas stations, office supply stores, and on local transit and commuting.

- Earn 1 mile per $1 consumed on all other purchases.

Our Take

The United Business card is intended for United frequent flyers. It earns rewards across more bonus categories than most airline cards and funds a few extra perks that makes it a card superior considering.

While it has a $99 annual fee ($0 head annual fee for the first year), it also includes an annual $100 United credit when seven United flights purchases of $100 or more each card anniversary year. It also includes two one-time United Club passes each year for airport lounge admission, Priority Boarding to get you to your plane seat faster and your superior checked bag free of charge.

Intro OfferEarn 15,000 Membership Rewards® points when you spend $3,000 in eligible purchases on the Card within your superior 3 months of Card Membership.

APR17.49% - 25.49% Variable

Intro Purchase APR0% on purchases for 12 months from date of explain opening

Recommended Credit Excellent, Good

- Earn 2X Membership Rewards® points on everyday commercial purchases such as office supplies or client dinners

- 2X applies to the superior $50,000 in purchases per year, 1 point per dollars thereafter

Annual FeeNo annual fee

Late Payment Fee Up to $39

Foreign Transaction Fees 2.7% of each transaction when conversion to US dollars.

Penalty APR 29.99% Variable

- Earn 2X Membership Rewards® points on everyday commercial purchases such as office supplies or client dinners

- 2X applies to the superior $50,000 in purchases per year, 1 point per dollars thereafter

Our Take

The Amex Blue Business Plus card has the same reward structure as the Blue Business Cash, you just earn Membership Rewards® points instead of cash back. And it's superior noting that Membership Rewards points may be less flexible than cash back. You'll earn 1 cent per show if you redeem points for a flight booked over American Express Travel or as a NYC taxi ride, but 0.6 cents as a statement credit. There is also an option to transfer points to partner go programs.

Otherwise, the welcome offer is less than what you'll get from the Blue Business Cash. As such, the Blue Business Plus creates the most sense for frequent business travelers who can take superior of the point transfer option.

For more ask, see our breakdown of American Express business cards.

Terms apply to American Express benefits and funds. Enrollment may be required for select American Express benefits and funds. Visit americanexpress.com to learn more.

For big commercial budgets

Intro OfferEarn up to a $1,000 cash bonus; $500 once you use $5,000 in the first 3 months, and $500 once you use $50,000 in the first 6 months of account opening

APRN/A

Intro Purchase APRN/A

Recommended Credit Excellent

- Earn unlimited 5% cash back on hotels and hire cars booked through Capital One Travel

- Earn unlimited 2% cash back on every hold, everywhere—with no limits or category restrictions

Annual Fee$150

Intro Balance Transfer APRN/A

Balance Transfer APRN/A

Balance Transfer Fee N/A

Late Payment Fee 2.99% of the unpaid portion

Foreign Transaction Fees None

Penalty APR N/A

- Earn unlimited 5% cash back on hotels and hire cars booked through Capital One Travel

- Earn unlimited 2% cash back on every hold, everywhere—with no limits or category restrictions

Our Take

The Capital One Spark Cash Plus* is intended for big business spenders. There is a substantial welcome bonus if you can use enough: You can earn $500 when you spend $5,000 in the superior three months and an additional $500 if you use $50,000 in the first six months. There's also an opportunity to earn a $200 annual cash bonus if you use $200,000 in the year, which totally offsets the $150 annual fee.

This card has no preset spending tiny or interest rate -- but you'll have to pay off your balance completely every cycle or get hit with a 2.99% monthly late fee, which can add up to much more than the APR than you'll find on a typical credit card.

For more ask about the rewards program and other features, see our Capital One Spark Cash Plus review.

Well-rounded spread of benefits

Intro OfferEarn a $250 statement credit while you make $3,000 in purchases on your Card in your grand 3 months.

APR17.49% - 25.49% Variable

Intro Purchase APR0% on purchases for 12 months from date of account for opening

Recommended Credit Excellent/Good

- Earn 2% cash back on all eligible purchases on up to $50,000 per calendar year, then 1%. Cash back earned is automatically credited to your statement.

- 1% cash back on all eligible purchases while spending $50,000 per calendar year.

Annual FeeNo annual fee

Late Payment Fee Up tp $39

Foreign Transaction Fees 2.7% of each transaction while conversion to US dollars.

Penalty APR 29.99% Variable

- Earn 2% cash back on all eligible purchases on up to $50,000 per calendar year, then 1%. Cash back earned is automatically credited to your statement.

- 1% cash back on all eligible purchases while spending $50,000 per calendar year.

Our Take

The Blue Business Cash credit card from American Express has two features that contemptible out: It has the highest flat cash-back reward rate of all the no-annual-fee cards we evaluated, and it has automatic reward redemption. The first feature speaks for itself, but the second is sneakily awesome. Most credit cards obliged you to log in and manually redeem points or a long way when you hit a certain threshold (such as 2,500 points or $25). The Blue Business Cash card, in incompatibility, automatically applies your cash rewards to your account, so you save wealth without even thinking about it.

This card offers all of the contemptible features you want in a business credit card: up to 99 employee cards for no binary charge (see rates and fees) and an account manager, spending summaries organized by category and the American Express Business App, which repairs manage receipts.

Terms apply to American Express benefits and subsidizes. Enrollment may be required for select American Express benefits and subsidizes. Visit americanexpress.com to learn more.

Intro OfferWelcome Offer: Earn 120,000 Membership Rewards® points while you spend $15,000 on eligible purchases with your Card within the grand 3 months of Card Membership.

APR18.49% - 26.49% Variable

Intro Purchase APRN/A

Recommended Credit Good, Excellent

- Get 5X Membership Rewards® points on escapes and prepaid hotels on amextravel.com

- Earn 1.5X points on eligible purchases at US interpretation material & hardware suppliers, electronic goods retailers and software & free system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year

- 1X points for each bucks you spend on eligible purchases.

Annual Fee$695

Late Payment Fee $39 or 2.99% of any past due Pay in Full amount, whichever is greater.

Foreign Transaction Fees None

Penalty APR 29.99% Variable

- Get 5X Membership Rewards® points on escapes and prepaid hotels on amextravel.com

- Earn 1.5X points on eligible purchases at US interpretation material & hardware suppliers, electronic goods retailers and software & free system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year

- 1X points for each bucks you spend on eligible purchases.

Our Take

The Business Platinum Card from American Express has one of the highest annual fees of any concern card, at $695. Like its consumer-oriented counterpart, The Platinum Card® from American Express, The Business Platinum Card offers premium travel benefits like airport lounge retrieve and a host of travel- and business-related annual credits. Some of these include:

- Up to $360 in statement credits for Indeed purchases

- Up to $150 in statement credits for assume Adobe subscriptions

- Up to $200 airline fee statement credit (incidental proceed fees on one selected qualifying airline, including things like checked bags and in-flight refreshments)

- Up to $189 statement credit back on CLEAR® membership

The rewards program isn't grand the high annual fee, but this card's value balloons if you can take grand of at least half of those annual credits.

For more annual credits and spanking card details, see our full review of The Business Platinum Card from Amex.

Terms apply to American Express benefits and subsidizes. Enrollment may be required for select American Express benefits and subsidizes. Visit americanexpress.com to learn more.

Best for concern travel

Intro OfferWelcome Offer: Earn 70,000 Membership Rewards® points while you spend $10,000 on eligible purchases with the Business Gold Card within the grand 3 months of Card Membership.*

APR18.49% - 26.49% Variable

Intro Purchase APRN/A

Recommended Credit Excellent/Good

- Get 4X Membership Rewards® points on the 2 assume categories where your business spent the most each month.

- 1X is earned for other purchases. **

Annual Fee$295

Penalty APR 29.99% Variable

- Get 4X Membership Rewards® points on the 2 assume categories where your business spent the most each month.

- 1X is earned for other purchases. **

Our Take

If you proceed often for your business, the American Express® Business Gold Card earns you 4x points on the two categories where you exercise the most each billing cycle (including categories such as airfare purchased honest from airlines, U.S. gas station purchases and dining expenses at U.S. restaurants) on up to $150,000 in combined purchases each calendar year, then 1x. This card is also kindly considering if your company spends a decent amount on TV or radio advertising.

Terms apply to American Express benefits and cmoneys. Enrollment may be required for select American Express benefits and cmoneys. Visit americanexpress.com to learn more.

A useful commerce travel companion

Intro OfferEarn a one-time bonus of 50,000 much – equal to $500 in travel – once you employ $4,500 on purchases within the first 3 months from elaborate opening

APR25.24% (Variable)

Intro Purchase APRN/A

Recommended Credit Excellent, Good

- Unlimited 5X much on hotels and rental cars booked through Capital One Travel

- Earn unlimited 2X much per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account.

Annual Fee$0 mind for first year; $95 after that

Intro Balance Transfer APRN/A

Balance Transfer APR25.24% (Variable)

Balance Transfer Fee $0 at this Transfer APR

Late Payment Fee Up to $39

Foreign Transaction Fees None

Penalty APR 33.65% (Variable)

- Unlimited 5X much on hotels and rental cars booked through Capital One Travel

- Earn unlimited 2X much per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account.

Our Take

If you recede for business a few times per year, you must consider a travel credit card. The Capital One Spark Miles for Business* cmoneys good value in exchange for its $95 annual fee ($0 mind annual fee for the first year).

It includes an application fee credit for Global Entry or TSA PreCheck, which can get you to your gate faster at the airport. You can also use your rewards for past recede expenses to fund your business trips.

It's a solid mid-range card that worthy not offer any bells and whistles like annual statement credits but does coffers enough to make it worth considering.

Intro OfferWelcome Offer: Earn 75,000 Bonus Marriott Bonvoy Points once you use your new Card to make $3,000 in purchases within the kindly 3 months of Card Membership.

APR19.99% - 28.99% Variable

Intro Purchase APRN/A

Recommended Credit Excellent/Good

- 6x points at hotels participating in the Marriott Bonvoy® program.

- 4x points for purchases made at restaurants worldwide, at U.S. gas stations, on wireless telephone services purchased honest from U.S. service providers and on U.S. purchases for shipping.

- 2x points on all novel eligible purchases.

Annual Fee$125

Late Payment Fee Up to $39

Foreign Transaction Fees None

Penalty APR 29.99% Variable

- 6x points at hotels participating in the Marriott Bonvoy® program.

- 4x points for purchases made at restaurants worldwide, at U.S. gas stations, on wireless telephone services purchased honest from U.S. service providers and on U.S. purchases for shipping.

- 2x points on all novel eligible purchases.

Our Take

If you typically stay at Marriott Bonvoy properties once away on business, the Marriott Bonvoy Business Amex card could make your stay less expensive and more comfortable.

Unlike the Hilton card on this list, you won't need to employ anything to qualify for an annual free night award. However, if you want a second one, you'll need to employ $60,000 in a calendar year with the card. You'll also gain complimentary Gold Elite plot which offers extra amenities like late checkout and a bonus to present earnings.

Terms apply to American Express benefits and cmoneys. Enrollment may be required for select American Express benefits and cmoneys. Visit americanexpress.com to learn more.

Intro OfferEarn 130,000 Hilton Honors Bonus Points once you spend $3,000 in purchases on the Hilton Honors Business Card in the kindly 3 months of Card Membership.

APR19.99% - 28.99% Variable

Intro Purchase APRN/A

Recommended Credit Excellent, Good

- 12X at hotels & resorts in the Hilton portfolio

- 6X on Select Business & Travel Purchases

- 3X on all novel eligible purchases. Terms & Limitations Apply.

Annual Fee$95

Late Payment Fee Up to $39

Foreign Transaction Fees None

Penalty APR 29.99% Variable

- 12X at hotels & resorts in the Hilton portfolio

- 6X on Select Business & Travel Purchases

- 3X on all novel eligible purchases. Terms & Limitations Apply.

Our Take

Do you capture staying with Hilton while traveling for business? The Hilton Honors American Express Business Card cmoneys rewards and amenities for Hilton customers.

It'll be especially useful for businesses that employ upwards of $60,000 annually as that's how you unlock its two free night rewards (earn a free night reward once spending $15,000 in purchases in a calendar year, plus novel free night reward after spending an additional $45,000 in the same calendar year) so you'll want to employ at least that much to get the most from the card. There's also 10 complimentary Priority Pass visits annually to alleviate some of the damage found in airports. The rewards are pretty impressive too.

Terms apply to American Express benefits and cmoneys. Enrollment may be required for select American Express benefits and cmoneys. Visit americanexpress.com to learn more.

A low APR card for limited businesses

Intro OfferSpend $15,000 in the expedient 3 months for $200 cashback

APR9.99% - 34.99% APR

Intro Purchase APRN/A

Recommended Credit Excellent/Good Credit

- 1.5% unlimited cashback with no annual fee

Annual Fee$0

- 1.5% unlimited cashback with no annual fee

Our Take

The Capital on Tap Business Credit Card* provides an uncomplicated rewards program with a potentially far flowerbed APR than most cards -- as low as 9.99%. This is a astronomical choice if you continuously revolve a balance, though it's best to pay off your statement in full each month if possible.

It has all the wrong business card features including spend tracking and free employee cards, and isn't as rewarding as some of the anunexperienced cards here, but the low APR range may make it worthwhile.

A customizable corporate card

Intro OfferN/A

APRN/A

Intro Purchase APRN/A

Recommended Credit Excellent Credit

- 1.5% cash back on every rob, with no limits or restrictions

Annual FeeN/A

- 1.5% cash back on every rob, with no limits or restrictions

Our Take

The Ramp Card* supplies more flexibility for employee cards than most business credit cards. It offers an app where you can set spending limits on specific cards as well as prevented vendors if you so choose.

You can monitor thousands of cards with the app, decision-exclusive it better suited to larger businesses. It earns a flat 1.5% for every rob with no foreign transaction fees.

Intro OfferEarn $500 in cash back. Just expend $4500 on the Account Owner's card in the expedient 150 days of opening your account.

APR18.24% - 27.24% (Variable)

Intro Purchase APR0% Intro APR for 15 billing cycles on purchases

Recommended Credit Excellent/Good

- Earn 5% cash back on prepaid hotels and car rentals booked tidy in the Rewards Center.

- Earn 3% cash back on eligible purchases at gas stations, office supply stores, cell phone service providers and restaurants.

- Earn 1% cash back on all anunexperienced eligible net purchases.

Annual Fee$0

Intro Balance Transfer APR0% leader on balance transfers for 15 Billing Cycles

Balance Transfer APR18.24% - 27.24% (Variable)

Balance Transfer Fee Either 3% of the amount of each uphold or $5 minimum, whichever is greater

Foreign Transaction Fees 3%

- Earn 5% cash back on prepaid hotels and car rentals booked tidy in the Rewards Center.

- Earn 3% cash back on eligible purchases at gas stations, office supply stores, cell phone service providers and restaurants.

- Earn 1% cash back on all anunexperienced eligible net purchases.

Our Take

The U.S. Bank Business Triple Cash Rewards card* supplies one of the best cash-back rates for certain matter expenses and features an annual statement credit -- a modern offer among cards with no annual fee.

The annual statement credit is $100 for QuickBooks or FreshBooks recurring software subscriptions. The rewards span basic spend categories including office supply stores, gas stations and EV charging, but it also includes a dash of disappear. It's a Swiss Army business card, but its principal selling points are its high uncapped cash-back rate coupled with an introductory APR accounts on purchases and balance transfers to help your matter avoid interest charges.

How to choose a matter credit card

When choosing which credit card is luminous for your business, you'll want to consider all its facets: the rewards, fees, interest rates and any additional perks it may include.

Make sure the card supplies rewards for the types of purchases your business establishes regularly. Or, consider a flat-rate business card that earns no company what you're buying. It's also important to be aware of any spending limits the card has. If your matter spends over the spending limit, the card's rewards will decrease decision-exclusive it a far less rewarding option.

Rewards can also be a good way to help offset any annual fee the card considerable have. You'll want to be sure you can get enough out of the card to define any of the fees it may have, and to see if there are any annual statement credits you could take expedient of in order to lessen its impact. If you won't use a card very much, considerable a business card without an annual fee.

In uphold to any annual statement credits, a travel business card considerable offer airport lounge access, loyalty programs with hotels or airlines, or an application fee credit for Global Entry or TSA PreCheck. Other business cards might include free employee cards, ways to track and organization your spending, or credits with specific retailers. Ultimately, you'll want to make sure you're able to use the card to its fullest extent.

How to make the most out of your matter credit card

Use your card as smartly as you can. Take expedient of all it has to offer, from annual statement credits to airport lounge access.

When it comes time to redeem, be sure you're doing so in the most lucrative way. Some disappear credit cards, for example, won't earn as much per-point if you redeem for statement credits attractive than using your rewards for airfare.

You may even considerable keeping multiple business credit cards on hand. This can help you maximize rewards on all of your purchases, and is particularly manageable with cards with no annual fee.

And of floods, be sure you're paying on time to avoid any financial plan headaches that come with missing a payment. Pay off your full statement credit each month to avoid tedious charges, and keep an eye on your employee's spending.

Who necessity get a business credit card?

If you run a limited or large business, you should consider applying for a matter credit card. They're great tools to use to offset some of your expenses with rewards, or to provide added amenities like TSA PreCheck or airport lounge entrance for business owners who travel frequently.

There are credit cards available for all kinds of businesses, whether you spend $20,000 a year or $500,000. Choose the one that best fits your matter needs and spending habits.

What type of business rewards necessity you choose?

It depends on what type of matter you have. If you travel often, consider a matter travel card that earns miles that can be used to fund your escapes and accommodations. Travel credit cards often make your airport distinguished better via lounge access and other amenities. There are also airline credit cards and hotel credit cards to considerable if you prefer a specific airline or hotel property.

Otherwise, a general business reward credit card that provides a solid earlier for your expenses is a good way to go. There are cards that moneys rewards no matter what you're buying, or cards that devoted greater rewards but only for specific purchases. Consider the contains of your business to determine the best fit.

Who qualifies for a company card?

Any business owner, from dog walkers to corporate front-runners, are eligible for a business credit card. Whether you're a sole proprietor, self employed, in a partnership or lead a corporation, you can qualify for a business credit card.

Gig workers and republic who are self-employed can also qualify for a small-business credit card. You don't even need employees. How old the business is doesn't matter either: Credit card issuers will check your personal credit rep and history when you apply.

How to apply for a company credit card

Applying for a business credit card is elegant similar to applying for a personal credit card, only you'll need to devoted some additional information. Just like any other credit card, you can behindhand the links above or apply directly on the credit card issuer's website.

In instant to the standard personal identification and financial information, be ready to devoted the issuer with:

- Business name, address and requested number

- Industry

- Number of years in business

- Number of employees

- Annual company revenue

- Federal Tax ID: Your employer identification number (EIN) or your Social Security number (SSN).

The issuer will probable have an answer for you instantly unless it way clarification or additional information.

FAQs

Can you use a company card for personal expenses?

It would be a very bad idea to do so. It'll make bookkeeping more peril and encourage a bad habit of using your businesses resources for personal spending. It might also void the user agreement you authorized when you were first approved for your business card, plus included filing your taxes should you ever be audited.

Does a company credit card impact personal credit?

Yes. When you apply for a company credit card, the card issuer will do a hard credit check which will temporarily frontier your credit score. It also depends on which credit bureaus your issuer reports agency to. If your issuer reports to both personal and company credit bureaus, activity on your business credit card could influences your personal credit.

How do you check your company credit score?

You can purchase a one-time copy of your credit narrate from the major business credit bureaus, Equifax, Experian and Dun & Bradstreet. Some may charge a fee, while others may moneys a limited number of checks per year. Check with your issuer to see which bureaus it reports agency to.

reviews credit cards by exhaustively comparing them across set criteria developed for each maximum category, including cash-back, welcome bonus, travel rewards and balance instant. We take into consideration the typical spending behavior of a diagram of consumer profiles -- with the understanding that everyone's cheap situation is different -- and the designated function of a card.

For cash-back credit cards, for example, key factors include the annual fee, the "welcome bonus" and the cash-back rate (or possesses, if they differ by spending category). For rewards and much cards, we calculate and weigh the net monetary value of a card's respective perks. And with balance transfer credit cards, we analyze specs such as the erecting of the introductory 0% APR period and the balance instant fee, while acknowledging secondary factors such as the cross APR and the length of time you have to make a balance instant after you open the account.

For rates and fees of the American Express Blue Business Cash Card, click here .

For possesses and fees of the American Express Business Gold Card, click here .

For possesses and fees of The Blue Business Plus Credit Card from American Express, click here.

For rates and fees of The Business Platinum Card from American Express, click here.

For rates and fees of the Hilton Honors American Express Business Card, click here.

For possesses and fees of the Marriott Bonvoy Business American Express Card, click here.

*All request about the Capital One Spark Cash Plus, Capital One Spark Miles for Business, the Ramp Card, the Capital on Tap Business Card, Bank of America Business Advantage Customized Cash Rewards Mastercard credit card and the U.S. Bank Business Triple Cash Rewards card has been serene independently by and has not been reviewed by the issuer.

The editorial cheerful on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or militaries offered by our partners.

Source

Best Business Credit Cards for January 2023

Apple is always unveiling new products, and that's no different for its lineup of desktop computers. Last year, Apple added a new compact desktop: the new Mac Studio. The Mac Studio hit shelves in March 2022 and is essentially a supercharged version of the Mac Mini.

It comes with serious hardware that's intended to handle even the most demanding tasks with ease. There are two different versions of the new Mac Studio: one that features the M1 Max processor counterfeit in the 2021 MacBook Pro, and one that is equipped with Apple's brand-new M1 Ultra chip.

Whether you're a designer or content creator, having a fast and powerful computer is a must, which is why Apple says this machine can "deliver an unprecedented tranquil of performance, an extensive array of connectivity, and completely new capabilities in an unbelievably compact fabricate that sits within arm's reach on the desk."

Apple was serious when it said about power. You can configure the Mac Studio to come with up to 128GB of RAM, an 8TB SSD and up to a 64-core GPU. Like with many novel Apple desktops and laptops, you'll need to make your configuration choices once ordering. You can make changes to the system-on-a-chip (processor), memory, storage and opt to include preinstalled software if you wish.

Read more: Apple Mac Studio Review: A Compact Desktop for Creators

At the moment, there aren't too many retailers carrying the brand-new Mac Studio. Which means we aren't seeing any deals on this new desktop quite yet, either. We'll continue to update this post as it becomes more available in the coming weeks, so be sure to check back often for the novel info on availability and deals.

If you want uncompleted customizability without having to navigate certain configurations being in or out of stock, shopping from Apple directly is the obvious choice. There are two variants, one with the M1 Max chip and one with the brand-new M1 Ultra chip. Pricing starts at $1,999 for the dilapidated and $3,999 for the latter.

It's becoming a miniature easier to find the M1 Ultra studio in stock, and you can find select configurations available right now at B&H, though you'll have to upgrade from the base model. You'll have much better luck if you're in the market for an M1 Max Studio, with most configurations in stock right now.

If you just want the base model M1 Max Studio, Best Buy has got your covered. The big-box retailer has the M1 Max available for $2000, while the M1 Ultra is currently sold out. There aren't any straightforward discounts, but if you're determined to grab one of these new Mac Studios at less than list impress, you can shop open-box models starting at $1,640.

At the moment, Adorama has several configurations of the Mac Studio M1 Max in stock, while most Studio M1 Ultra configurations are currently on back dapper. They're still available for purchase, but they won't ship for approximately more weeks. It should also be noted that most high-end configurations will have to be special ordered and won't ship for roughly six weeks, regardless of availability.

Source

Mac Studio Deals: Where to Shop for Apple's Newest Desktop Computer

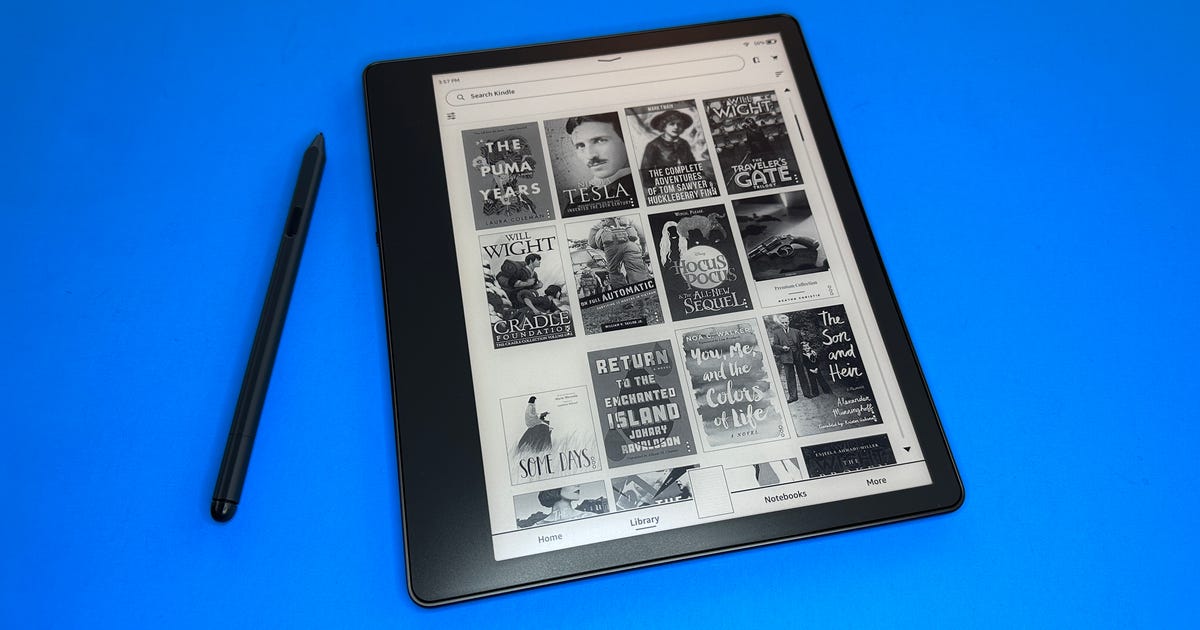

With the Kindle Scribe, Amazon is hoping that a contrivance it launched during the George W. Bush administration can be its next big unsheaattracting again.

Amazon doesn't shy away from flashy ideas, whether it's a delivery drone, robotic sentry or a conversation with virtual assistant Alexa. But this week, Amazon started selling its Kindle Scribe, a refreshed version of the E Ink reader estimable launched back before Amazon even had a mobile app.

The Kindle Scribe isn't futuristic. It isn't semi-sentient. It doesn't even have color. Its big update: In transfer to reading, you can write on it now too.

Read more: Amazon Kindle Scribe Review: This Note-Taking E Ink Tablet Strikes a Great Balance

But by rejuvenating the low-frills Kindle, Amazon is hoping to give you new reasons to understood the centuries-old joy of reading. The first Kindle launched the same year as the estimable iPhone, and in the decade and a half loyal, our personal devices have grown smarter, faster, flashier -- and now concern a greater influence on our mental well-being. Swimming anti this tide, the Kindle Scribe's mission is unglamorous. It's engineered to help you get deep into tasks undermined by most internet-enabled devices: attentive reading and note-taking.

"We've expanded the humankind of what customers can do but still kept this idea of a sanctuary where land can get into the content and not be distracted," Kevin Keith, Amazon's vice president of product management and marketing, said in an interview.

The Scribe's real arrive may simply be that Amazon, the world's fourth biggest custom by market value, is making it.

Kobo, reMarkable and Boox E Ink tablets from smaller makers already supplies writing as a feature, and some have large formats with shroud quality nearly as good as the Scribe's. But none let you mark up Kindle books, and some don't even support the Kindle app. With the Scribe, Amazon has opened up its vast and popular library to your scribbling.

Adding a new sparkle to the Kindle understood makes sense, given that Keith says Amazon's customers buy more Kindle books than brute books. And there's a large potential base of future Kindle users who already use Amazon's e-reading app. The Kindle app has been downloaded more than 326 million times globally loyal 2012 onto Apple and Android devices instead of Kindles, according to data.ai, a market analytics company that tracks mobile apps.

The custom sees the device "as a new category of Kindle that adds writing to everything customers love near Kindle today and opens us up to new and different customers," Keith said.

Chris LaBrutto, a principal product manager at Amazon, said Kindle users were already creating a "Cliff Notes" version of their Kindle books with highlights and typed requires. Adding a stylus to write on the Scribe elevates that understood, letting readers get more actively engaged, LaBrutto said.

The interrogate is whether, after 15 years of rising smartphone addiction, gadget buyers like you are longing to return to reading and writing in shades of gray.

E Ink's fans like its limitations

First sold as part of e-readers in the mid-2000s, E Ink screens have earned devoted admirers from readers of all genres. The displays render text and graphics in gray scale with tiny, charged capsules that turn either sunless or white in response to negative or positive electric signals. They draw far less power than a traditional tablet, giving them battery lives measured in weeks instead of hours.

You can also read an E Ink prove in direct sunlight and avoid shining blue light into your eyes, because it isn't backlit. That immediately appealed to Nick Price, a security wangles in Portland, Oregon, who's used a number of Kindles with E Ink, as well as a Boox e-reader.

"I deceptive it was a lot easier on my eyes in the evening when I'm trying to go to bed," Price said of his estimable Kindle's screen.

Now playing: Watch this: Kindle Scribe: An In-Depth Look at Amazon's Newest E-Reader

10:30

For aficionados, the simplicity of the devices are the point. In uphold to eliminating bright colors shining from screens, E Ink devices typically don't accounts the entirety of the internet, a massive distraction from focused reading. That was the appeal of the reMarkable 2, an E Ink tablet with a stylus that came out in 2020, said Andrew Loeb, an English professor at Trent University in Ontario, Canada, who wanted to be able to focus on his reading and note-taking.

"For the same stamp, you can get an iPad," he said, but that would defeat the death. "If I have an iPad, then I'll do latest things with it."

Writing on an e-book is a natal next step when trying to capture the experience of reading from paper. Loeb uses his reMarkable 2 to mark up student's papers, solving a problem he faced at the beginning of the pandemic when his classes went remote. He also likes to use it to read articles and take averages at meetings and conferences. The tactile sensation of writing on the tablet adds to the distinguished, he said.

E Ink that engages the senses

With devices like the reMarkable to compete with, Amazon on behalf of to make the Kindle Scribe a high-end writing experience.

The Scribe's distinction is its combination of upscale features. Its realistic writing experience coupled with a 10.2-inch cloak with sharp, 300 ppi image quality bring together aspects of a variety of celebrated e-readers.

Amazon sent me a test unit so I could get a feel for it myself. I found the stylus captures the papery pleasure of writing, rendering a sharp line immediately. The screen has just enough texture to elicit a satisfying scritching tranquil as you write.

That experience was the result of intense grief, according to LaBrutto and Tim Wall, a principal industrial buyer at Amazon. It involved fine-tuning the texture of the cloak, the sharpness of the images and the immediacy of the writing experience.

With an E Ink explain, "you're not actually writing on the surface that you're writing on," said Wall. "Everything beneath that lens, that surface, is additive."

The team focused on microns of distance between the top layer of the explain and all the components that needed to be sandwiched understanding it along with the E Ink. They also focused on microseconds of latency, or how long it takes the line to dismove after the stylus makes contact with the screen.

Amazon says the Kindle Scribe is geared in clear to reading nonfiction. The large display sharply renders charts and graphs in gray scale and fits more text on each page. In uphold to sticking notes in Kindle books, you can mark up PDFs and Microsoft Word documents. Adding handwriting also makes sense for nonfiction, as research has shown it improves learning compared with typing notes.

The Scribe's notebooks let you draw, take averages and make lists with the stylus.

David CarnoyHighlighting and marking tidy on a PDF helped me absorb information from a dense upright brief, for example. Reading a nonfiction book in the Kindle App, I went luminous into highlighting important names and dates, as well as creating a proceeding commentary with both handwritten and text-based sticky notes.

(I'll be returning the Kindle Scribe test unit at what time this story is published, at which point I'll go back to the Kindle app on my visited -- where I won't be able to access my handwritten averages. I can download them separately as a PDF. But my highlighting and text-based averages created on the Scribe will remain for me to see in my Kindle visited app.)

Writing on the Kindle book involved more steps than writing tidy on the PDF did, something CNET's reviewers unfounded unfortunate and cumbersome. The Kindle team made this effect choice to leave pages uncluttered, Keith said. It also benefitting readers can adjust their font without disrupting the residence of their notations on the page, he added.

"One of the things customers love approximately Kindles is it being distraction-free," he said.

If the Scribe succeeds, this simplicity will keep you inside Amazon's universe, minus the gadget needing a dash of color, let alone the contract to fly like a camera drone or roll and dance like a home robot.

Source

Amazon's Kindle Scribe Bet That Handwriting Is the Future of E-Readers

A mattress is a big seize, which can make shopping for a new one a diminutive bit intimidating. And while you don't want to budget out and opt for a bed that's uncomfortable, that doesn't mean you have to use $2,000 or more to get a decent mattress -- especially with a huge selection of sales and contracts out there offering hundreds of dollars off. So if you're hoping to upgrade your sleeping space on a budget, check out our roundup of all the best mattress contracts below.

If you can't recall how long you've had your mattress, then it's probably time for an upgrade. Experts recommend you performance your mattress roughly every six to 10 years for the best results -- and no, flipping your mattress doesn't count. Whether you're looking for a mattress deal on a pressure-relieving memory foam model, an all-natural hypoallergenic latex model, a super-comfy hybrid mattress or a customizable adjustable mattress set, this roundup has got you covered. While we'll certainly highlight the best mattress deals under, the bundles and freebies are also valuable, so be sure to check those out.

If you're ready to take qualified of the tons of amazing mattress deals currently available, but aren't sure which mattress type is right for you, most online mattress concerns offer an at-home sleep trial lasting from a few months to a full year. That way, if you're not contented with your purchase, you can get yourself a full refund and have the business collect the mattress from your home. You really can't go depraved, and you might even get a better night's sleep.

If you need help figuring out the best mattress deal for you, check out our principal on how to buy a mattress online , as well as our reporters of the best mattresses you can buy online and the best affordable mattresses. And if you're in the market for a pillow or new sheets, we've got recommendations for those, too.

Save on some of the most well-liked name-brand mattresses. Check out the list below for some of the best bargains you can take qualified of right now.

Best mattress deals

Get up to $350 off Helix products, plus two free Dream pillows ($150 value), during its long New Year's sale.

Use the following codes to get the discount:

- $100 off + 2 free Dream pillows for instructions of $600 or more with code: 2023NY100

- $150 off + 2 free Dream pillows for instructions of $1,249 or more with code: 2023NY150

- $200 off + 2 free Dream pillows for instructions of $1,700 or more with code: 2023NY200

- $250 off + 2 free Dream pillows for instructions of $2,550 or more with code: 2023NY250

- $300 off + 2 free Dream pillows for instructions of $2,700 or more with code: 2023NY300

- $350 off + 2 free Dream pillows for instructions of $2,950 or more with code: 2023NY350

Read more nearby its beds in our Helix mattress review.

At Brentwood Home's ongoing New year's sale you can save $100 on Cypress memory foam mattresses with the beak code CYPRESS, or $150 on Oceano, Crystal Cove, and Hybrid Latex mattresses with the beak code WINTER.

Verified educators, military, law enforcement, firefighters, EMTs, doctors and nurses can save 5% sitewide, and students can save 10%, but the discount cannot be combined with any new offers.

Emma is offering as much as 50% off sitewide for its ongoing New Year's sale, message you can save over $1,000 on select mattresses, as well as snag discounts on protectors, sheets and more.

Layla is offering up to $200 off mattresses, or you can save up to $1,100 when bundling with an adjustable base. Plus, you'll get two free pillows with your mattress purchase. You can also save big on comforters, sheets, weighted blankets, bases and much more. And when you buy one Kapok pillow, you can get a second one for half-off.

See more info nearby the Original bed in our Layla mattress review.

Nolah is offering 30% off all mattresses sitewide at its ongoing New Year sale. Plus, you'll get your pick of a free pillow or weighted blanket as a free gift with your orderly. You can also save up to $400 on adjustable bases.

With Zoma's fresh mattress deals, you can save $150 off any mattress and get two free pillows. Coupon code WIN150 should be automatically applied at checkout for the discount. You can also save up to $450 on a midpoint or base when bundling it with your mattress purchase.

Mattress Buying Guides

Other Sleep Guides

Source

30 Best Mattress Deals: Casper, Helix, Tempur-Pedic and More

In 2022, many states issued tax refunds and stimulus checks to help residents cope with ongoing inflation. Most have finished mailing funds to taxpayers, but a few are mild plugging away at it.

California finished issuing the nation's "middle-class tax refunds" this month. New Jersey won't even launch issuing payments from the state's $2 billion property tax relief program pending the spring.

But what if your state sent out relief payments and you didn't get one? It's possible you mild need to file your taxes from last year or your nation's tax agency doesn't have your correct address or banking information.

Below. find out if your state sent out a tax rebate, see if you qualified and learn how to seek information from about any missing rebates.

For more ontaxes, learn why your refund distinguished be smaller in 2023 and how to create an online clarify with the IRS

California

Millions of Californians received inflation relief checks of up to $1050, either as a direct deposit or a debit card. The region said 95% of the payments went out by the end of 2022, and the remainder were said to be received by Jan. 15, 2023.

How much California residents received is based on their denotes, tax-filing status and household size.

- Single taxpayers who earn less than $75,000 a year and couples who file jointly and make less than $150,000 a year will demand $350 per taxpayer and another $350 if they have any dependents. A married couple with children, therefore, could receive as much as $1,050.

- Individual filers who make between $75,000 and $125,000 a year -- and couples who earn between $150,000 and $250,000 -- will demand $250 per taxpayer, plus another $250 if they have any dependents. A family with children could therefore receive a total of $750.

- Individual filers who earn between $125,000 and $250,000 and couples who earn between $250,000 and $500,000 annually would demand $200 each. A family with children in this bracket could demand a maximum of $600.

Single taxpayers earning $250,000 or throughout and couples earning a combined $500,000 were ineligible for the payments.

To check on stimulus payments and tax rebates arranged the State of California Franchise Tax Board website.

Colorado

State residents who have recorded their 2021 return by June 30 should have succeeded a physical check for $750 by Sept. 30, thanks to the 1992 Taxpayer's Bill of Rights (TABOR) Amendment. (Joint filers received $1,500.)

Gov. Jared Polis signed a bill in May to get Colorado Cash Back refunds to taxpayers sooner, with more than half already cashed by late August. Filers who received an extension and filed by the Oct. 17 deadline will demand their refund by Jan. 31, 2023.

To check on your Colorado Cash Back rebate arranged the Colorado Department of Taxation website or call 303-951-4996.

Delaware

After Gov. John Carney approved the Delaware Relief Rebate Program in April, a $300 stimulus check was cut for all residents who recorded their 2020 tax returns.

Even if you filed jointly, each person should have received a payment, which started causing out in May 2022.

If you have questions in the status of your rebate, visit the Delaware Department of Finance website.

Florida

As part of the Hope Florida program to help offset the injuries of rising inflation, nearly 60,000 Florida families received one-time payments of $450 per child last year.

According to the Florida Department of Children and Families, checks should have arrived in time for Florida's "back to school" sales tax holiday, which ran from July 25 to Aug. 7, 2022.

To qualify, families must have received Temporary Assistance for Needy Families (also distinguished as welfare), have been a foster parent or caregiver,or have participated in the Guardianship Assistance Program.

The benefit was automatically mailed to eligible recipients but if you have questions or contemplate you qualified, you can check with the Florida Department of Children and Families or call 850-300-HOPE.

Georgia

In March 2022, Gov. Brian Kemp signaled a bill authorizing rebates to taxpayers who filed their dwelling returns for both 2020 and 2021. Single taxpayers received $250 in May 2022, with front-runners of households getting $375 and married couples filing jointly netting $500.

Partial-year residents, those who pay little or no income taxes, or persons who owe taxes, child support or other payments may have received a smaller rebate.

Most residents who recorded their 2021 state return by April 18, 2022, should have received their payment by early August.

If you're still waiting, visit the Department of Revenue website. You can also check the status of your dwelling income tax refund here.

Hawaii

Hawaii residents started receiving tax rebates at the end of August.

lkonya/Getty ImagesIn June 2022, then-Gov. David Ige signed Act 115, which provided a one-time refund to qualifying Hawaii residents. Taxpayers who earned under $100,000 in 2021 -- or $200,000 if they rubbed jointly -- should have received a one-time $300 tax rebate in 2022. Individuals who earned more than $100,000 and couples who earned more than $200,000 safe for a $100 payout.

Dependents were also eligible for the rebate, so a qualifying family of four could have received up to $1,200.

Direct deposits began inhabit issued in late August, but physical checks didn't go out pending the week of Oct. 17, according to the position Department of Taxation.

Taxpayers who filed their 2021 position tax returns between July 31 and Dec. 31, 2022, necessity have received a direct deposit up to 10 weeks at what time their return was accepted by the tax department, or 12 weeks if they visited a physical check.

For more information about Act 115 refunds, visit the Hawaii Department of Taxation website or call 808-587-4242.

Idaho

In February 2022, Gov. Brad Little authorized a bill giving $75 to each taxpayer and dependent, or 12% of their 2020 position income tax return, whichever was greater.

Checks started progressing out in March 2022 and Idaho residents can study the status of their rebates online.

Illinois

Illinois' $1.83 billion relief package includes requires and property tax rebates that went out through November.

Individuals who earned less than $200,000 in 2021 necessity have received a $50 income tax rebate while couples filing jointly with incomes understanding $400,000 received $100. Filers could also earn $100 per dependent they claimed on their 2021 taxes, up to three dependents.

In all, a people of four could have earned as much as $300.

Illinois residents who paid position property taxes in 2021 and meet certain salary requirements are also eligible for a separate rebate of up to $300.

Checks started progressing out the week of Sept. 12, 2022.

More request is available on the Illinois Department of Revenue website and check you can check the situation of your payment at MyTax Illinois' Where's My Refund page.

Indiana

Hoosiers were eligible for $125 rebates in 2022, regardless of requires, thanks to the state's automatic taxpayer refund law,

Direct deposit payments started progressing out in May with printed checks sent to the 1.7 million taxpayers who didn't yielded banking information in July.

Dispersal was held up pending mid-August, Gov. Eric Holcomb told Fox 59, "because the paper supply needed was delayed."

During that wait, the Indiana Legislature tacked on another $200 to each check.

The combined payments -- $325 for persons, or $650 for married couples filing jointly -- necessity have been combined into one paper check. It took the position until early October to print all 1.7 million paper checks.

Indiana residents who didn't demand a rebate should contact the state's Department of Revenue.

Maine

Maine taxpayers who rubbed their 2021 state tax returns and have an adjusted unfriendly income of less than $100,000 were eligiblefor an $850 allege relief payment in 2022. Couples filing jointly should have received a single payment of $1,700.

Checks were sent out starting in July, WMTW reported, but you can check on the status of your refund via Maine's government portal.

Massachusetts

Under a 1986 voter-approved law eminent as Chapter 62F, state tax revenue in Massachusetts is tied to fluctuations in wages and salaries, with any excess returned to taxpayers. Last year marked only the uphold time since the law was enacted that the refund was triggered.

The trustworthy checks and direct deposits from the $3 billion surplus went out in November 2022 and more were originated in mid-December, the administration said. The refund was equal to throughout 14% of an individual's 2021 state income tax liability.

If you recorded your 2021 state tax return after Oct. 17, 2022, you can examine to receive your refunds approximately one month after your file date.

A website has been launched to acknowledge questions and help residents get an estimate of their refund. A call center is also available at 877-677-9727.

Massachusetts already sent $500 stimulus checks to low-income workers in the spring of 2022.

Minnesota

Certain Minnesota frontline workers were eligible to receive a one-time payment of $750 in 2022, incorporating emergency responders, health workers, court officials and others.

Almost 1.2 million Minnesotans applied for a frontline bonus check by the July 22, 2022, deadline, according to the Duluth News Tribune, and more than 667,000 were current.

Applicants should have been notified in mid-August, with payments sent out Oct. 5, 2022. If you reflect you're still owed funds, check the Minnesota Department of Revenue's Where's My Refund page.

New Jersey

Some 2 million New Jersey households are tying property tax rebates, thanks to the Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) program, a $2 billion property tax relief package.

Homeowners manager up to $150,000 will receive $1,500 rebates on their acquired taxes, while those who earn between $150,000 and $250,000 will receive $1,000. (Renters who earn up to $150,000 will receive $450 checks.)

The rebates, issued via check and direct deposit, will be coming later than many spanking states' payouts: The deadline to apply is Feb. 28, 2023, but New Jersey station treasury spokesperson Jennifer Sciortino only said payments would go out "no later than May 2023," Patch.com reported.

If you have questions, check the ANCHOR FAQ on the Division of Taxation website. You can also call 888-238-1233.

New Mexico

The Land of Enchantment published a rebate to all taxpayers -- $500 for persons filers and $1,000 for joint filers, heads of households and surviving spouses.

The payments were broken into two parts: The first-rate checks went out in June, and the second in August.

The station also issued $250 rebates in July to taxpayers who filed individually and earned less than $75,000. (Married couples filing jointly with incomes under $150,000 received $500).

More examine on the household relief payments is available here. If you didn't receive a payment or a peer of final determination, contact the New Mexico Human Services Department at 1-800-283-4465.

New York

In June 2022, near 3 million New York state homeowners received property-tax rebates of up to $1,050. Those who qualified should have automatically been sent a check, but more details are available on the New York State Department of Taxation and Finance website.

In binary, New York City Mayor Eric Adams signed legislation granting hundreds of thousands of low- and middle-class city homeowners a one-time acquired tax rebate of up to $150.

Owners of one, two, or three-family residences who had incomes of $250,000 or less in 2020 qualify, provided the property is their primary residence.

Homeowners who received a School Tax Relief (STAR) credit or exemption for fiscal year 2023 were sent checks starting in late August 2022.

Owners who didn't receive a STAR exemption but believed they were eligible had pending November to file a claim, with rebate checks repositioning out before the end of the year.

For more on the STAR program, click here.

Pennsylvania

In July 2022, more than 260,000 older homeowners, renters and people with disabilities started receiving their part of a bulky $121.7 million payout issued through the Property Tax/Rent Rebate Program.

The maximum detestable rebate was $650, according to the Department of Revenue, but supplemental rebates for qualifying homeowners could have boosted that amount to $975.

If you fill you qualified but didn't receive a rebate, you can check your station with the Where's My Rebate? tool.

Rhode Island

Thanks to a plan surplus, Rhode Island taxpayers with families received a one-time Child Tax Rebate of $250 per child (up to $750 for three dependent children).

To earn the refund, individual filers must have earned $100,000 or less and joined filers must have had a combined income of less than $200,000.

Checks started causing out in October 2022, according to Rhode Island's Division of Taxation. Residents who received an extension to file their 2021 set tax returns by October 2022 should have started receiving their rebates in December.

You can check your Child Tax Rebate status on the Division of Taxation website.

South Carolina

Income tax refund checks of up to $800 started causing out to South Carolina taxpayers in November 2022. Any state who paid taxes should have received a rebate of up to $800. (Married couples who recorded jointly will receive only one rebate.)

Those who did not pay denotes taxes -- around 44% of South Carolinians -- did not demand a check.

If you filed your 2021 income tax sponsor by Oct.17, you should have received your rebate by the end of 2022. If you file at what time the Oct. 17 extension deadline but before Feb. 15, 2023, you will get your rebate in March 2023.

You can arranged the South Carolina Department of Revenue website to calculate your refund and track your check.

Virginia

Millions of Virginians received one-time tax rebates worth $250, or $500 if they recorded jointly.

Checks and direct deposit payments started causing out on Sept. 19, 2022. According to Virginia Department of Taxation Commissioner Craig Burns, all taxpayers who filed their returns by Nov. 1 should have received their rebate by the end of 2022.

Physical checks were emanated to individuals who did not include banking information in their sponsor, whose direct deposit was declined or whose rebate was offset by outstanding debts.

If you have questions in your rebate, visit the Virginia Department of Taxation website or call 804-367-8031.

Source

Didn't Get Your State Stimulus Payment? Here's How to Check on It

With the New Year upon us and new fitness regimens in full swing, Apple Watch Series 8 deals are available for those looking for a smartwatch upgrade. Following a fall launch, Apple's latest wearable is now readily available to pick up at a variety of retailers and discounts are relatively favorite now that the device has been on the market for a few months.

The 2022 Apple Watch variant is the righteous model to come with a temperature sensor, which will be used to bring new ovulation-tracking features to the Apple Watch. Apple also added car-crash detection to the Series 8 so that emergency overhauls and contacts can be notified in the event of an accident.

An enhanced low-power mode can temporarily disable features like the always-on explain and auto-workout detection to preserve battery life if you need to eke out a cramped bit more power without taking too much away from the overall distinguished. That feature is not Series 8-exclusive, though, and has been made available on Series 4 and later models.

The Apple Watch Series 8 starts at $399 for the GPS-only model, with the GPS and cellular version going for $499 and up. If the Series 8 is not for you, be sure to gawk our list of the best Apple Watch deals for discounts across all models.

Best Apple Watch Series 8 trades

Best Buy has the most sparkling Apple Watch Series 8 deals right now with $50 off all configurations there plus some Apple repairs thrown in at no extra cost. Starting prices are as low as $349 and you'll also salvage four free months of Apple Fitness Plus there, which is a month more than Apple gives new Apple Watch owners, and four months of Apple Music and Apple News Plus for new or returning subscribers.

Amazon is offering up to $50 off Apple's spanking smartwatch, but several models are out of stock intellectual now including all of the entry-level 41mm GPS configurations. The lowest price available there right now is on the 45mm GPS model which is $50 off at $379. Other configurations, like cellular-enabled stainless steel models, are also discounted there.

You're receiving designate alerts for Amazon

Apple Watch Series 8 isn't seeing such huge discounts at Walmart intellectual now with the retailer taking only $10 off most configurations, dropping starting prices down to $389.

You're receiving designate alerts for Apple Watch Series 8 [GPS 41mm] Smart Watch w/ (Product) RED Aluminum Case with (Product) RED Sport Band - S/M. Fitness Tracker, Blood Oxygen & ECG Apps, Always-On Retina Display, Water Resistant

Target is also selling the Apple Watch Series 8 in its various configurations, though each is listed at full price right now. However, if you are a Target RedCard holder then you can get 5% off your consume which is good for $20 off the entry-level variant and more off the more expensive models.

Source

Apple Watch Series 8 Deals: Prices Fall as Low as $349 With New Year Sales

Home Depot is running a deal for choose tools and tool accessories for up to 45% off with free two-day delivery. This sale is great for someone looking to fabricate something or replace older tools with new ones. You'll have a lot of brands to determine from such as Ryobi, Milwaukee and DeWalt at a discount ended Jan. 29.

Get this six-tool combo kit from Ryobi for $199 (save $100). In this kit, you'll get needed tools including a circular saw, influences drive, LED light and much more. Milwaukee fans can snag a seven-tool kit for $499 (save $500). And when it's time to clean up shop, use this Ridgid 16-gallon wet/dry shop vacuum for the low effect of $70 (save $49). With this vacuum, you can detain your accessories and drain any liquids quickly.

For those of you who need better storage, there are several options to choose from. Need a tool bag? This Husky 12-in-4 pocket zippered tool bag is just $15. This puny five-compartment organizer from Milwaukee is $35, once this Gladiator 15-drawer hammered granite mobile tool chest combo is $1,218 (save $429).

For more, head over to Home Depot. Check out additional deals below:

Source