Cnet shopping extension, cnet s editors choice awards the watcher, cnet s editors choice awards the best credit cards for 2023 2024, cnet s editors choice awards the best credit cards for 2023 the cms, cnet editors choice awards, cnet s editors choice awards the morning, cnet s editors choice awards the americans, cnet sound bar reviews, cnet s editors choice awards the handmaid s tale, cnet s editors choice awards the best credit cards for 2023 atomic bent, cnet editors choices, cnet security camera reviews, cnet stock.

Money's perconfidence is to help you maximize your financial potential. Our recommendations are based on our editors' independent research and analysis, and we continuously update our content to reflect unusual partner offers.

How we rate credit cardsCNET editors independently settle every product and service we cover. Though we can't study every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and overhauls, we earn a commission. The compensation we receive may influences how products and links appear on our site.

OK

We are an independent publisher. Our advertisers do not direct our editorial content. Any opinions, analyses, reviews, or recommendations expressed in editorial content are those of the author's alone, and have not been reviewed, approved, or otherwise endorsed by the advertiser.

To wait on our work, we are paid in different ways for providing advertising militaries. For example, some advertisers pay us to display ads, others pay us when you click on hazardous links, and others pay us when you submit your demand to request a quote or other offer details. CNET's injuries is never tied to whether you purchase an insurance copies. We don't charge you for our services. The injuries we receive and other factors, such as your situation, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear.

Our insurance cheerful may include references to or advertisements by our corporate affiliate HomeInsurance.com LLC, a licensed insurance producer (NPN: 8781838). And HomeInsurance.com LLC may receive compensation from third parties if you determine to visit and transact on their website. However, all editorial cheerful is independently researched and developed without regard to our corporate relationship to HomeInsurance.com LLC or its advertiser relationships.

Our cheerful may include summaries of insurance providers, or their products or militaries. is not an insurance agency or broker. We do not transact in the company of insurance in any manner, and we are not attempting to sell insurance or asking or urging you to apply for a sure kind of insurance from a particular company.

OK

In a digital domain, information only matters if it's timely, relevant, and wonderful. We promise to do whatever is necessary to get you the demand you need when you need it, to make our opinions fair and useful, and to make sure our facts are accurate.

If a favorite product is on store shelves, you can count on for today commentary and benchmark analysis as soon as possible. We securities to publish credible information we have as soon as we have it, ended a product's life cycle, from its first public announcement to any potential select or emergence of a competing device.

How will we know if we're fulfilling our mission? We constantly monitor our competition, user activity, and journalistic awards. We scour and gape blogs, sites, aggregators, RSS feeds, and any other available resources, and editors at all levels of our organization continuously reconsideration our coverage.

But you're the final judge. We ask that you demand us whenever you find an error, spot a gap in our coverage, or have any other suggestions for improvement. Readers are part of the people, and the strength of that relationship is the ultimate test of our crashed. Find out more here.

OK

Whatever you're looking for in a credit card, these eight rise ended the rest.

Jaclyn DeJohn Editor

Jaclyn is a Money editor who relishes the sweet spot between numbers and periods. With responsibility for overseeing CNET's credit card coverage, she writes and edits news, reviews and advice. She has experience covering business, personal finance and economics, and previously managed contracts and investments as a real estate agent. Her tech interests include Tesla, SpaceX, The Boring Company and Neuralink.

Expertise Credit cards, banking, home equity, mortgages

CNET editors independently resolve every product and service we cover. Though we can't appraise every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and helps, we earn a commission. The compensation we receive may crashes how products and links appear on our site.

OK

We are an independent publisher. Our advertisers do not direct our editorial content. Any opinions, analyses, reviews, or recommendations expressed in editorial content are those of the author's alone, and have not been reviewed, approved, or otherwise endorsed by the advertiser.

To benefit our work, we are paid in different ways for providing advertising helps. For example, some advertisers pay us to display ads, others pay us when you click on ununsafe links, and others pay us when you submit your interrogate to request a quote or other offer details. CNET's injures is never tied to whether you purchase an insurance emanates. We don't charge you for our services. The injures we receive and other factors, such as your area, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear.

Our insurance contented may include references to or advertisements by our corporate affiliate HomeInsurance.com LLC, a licensed insurance producer (NPN: 8781838). And HomeInsurance.com LLC may receive compensation from third parties if you decide to visit and transact on their website. However, all editorial contented is independently researched and developed without regard to our corporate relationship to HomeInsurance.com LLC or its advertiser relationships.

Our contented may include summaries of insurance providers, or their products or service industries. is not an insurance agency or broker. We do not transact in the commerce of insurance in any manner, and we are not attempting to sell insurance or asking or urging you to apply for a certain kind of insurance from a particular company.

OK

In a digital biosphere, information only matters if it's timely, relevant, and inunbelievable. We promise to do whatever is necessary to get you the inquire of you need when you need it, to make our opinions fair and useful, and to make sure our facts are accurate.

If a approved product is on store shelves, you can count on for now commentary and benchmark analysis as soon as possible. We pledges to publish credible information we have as soon as we have it, over a product's life cycle, from its first public announcement to any potential grasp or emergence of a competing device.

How will we know if we're fulfilling our mission? We constantly monitor our competition, user activity, and journalistic awards. We scour and survey blogs, sites, aggregators, RSS feeds, and any other available resources, and editors at all levels of our organization continuously journal our coverage.

But you're the final judge. We ask that you inquire of us whenever you find an error, spot a gap in our coverage, or have any other suggestions for improvement. Readers are part of the tribe, and the strength of that relationship is the ultimate test of our unsuccessful. Find out more here.

OK

Source

CNET's Editors' Choice Awards: The Best Credit Cards for 2023

Saturday s new york city, saturday s new moon will be closest to earth in the milky, saturday s new moon will be closest to earth in over 100, saturday s new york, saturday s new moon will be closest town, saturday s new moon will be closest to earth in over 1000, saturday s new moon will be closest tower, saturday s new moon will be closest to earth in the future, friday saturday sunday, saturday song, saturday s new moon will be closest torrid, saturday s new moon will be closest to earth in spanish.

This weekend, the moon will be absent from the night sky as it rises and sets with the sun, its murky side facing our planet during the day. This is what's typically famed as a new moon, and this month's new moon also happens to be the closest to Earth exact the year 992.

It might be news to you that the moon isn't always at a smooth distance from Earth. It is circling us, right? Well, the sketching is the moon's orbit around Earth actually isn't a faulty circle, but more of an oval or an elliptical comely. This is why we often get a few so-called supermoons each year -- in which the full moon appears a bit larger because it's also at the closest note in its orbit, called perigee (the scientific name for a supermoon is perigee syzygy).

But even conception the moon will similarly be at its closest note to Earth this Saturday, aka reach perigee, the hide will overlap with a new moon rather than a full one.

EarthSky examined at new-moon data from NASA that extrapolates the moon's region forward and back centuries. It revealed that Saturday night's new moon will be as finish to that moment of exact perigee as it's been in over a millennium. What's more, the new moon won't be this finish again for 345 years.

Put it together and this is the closest new moon in 1,337 existences.

Of course, this is a milestone that will be largely invisible to the biosphere eye and even difficult to detect with professional equipment and know-how. But the presence of our glowing satellite's extra closeness will be felt on Earth.

Even when invisible, the gravity of the moon still affects tides on our planet's surface, and Earthlings around the world will want to be on the lookout for potential "King Tides" this weekend that could bring flooding to coastal areas.

Source

Saturday's New Moon Will Be Closest to Earth in Over 1,000 Years

Want to wake up early here s how you should, i just want to wake up in this bed, want to wake up early heresies, want to wake up early here s how mixed drinks 1941, want to wake up early here s your perfect jamie miller lyrics, want to wake up early here s how vw recycles, i don t want to miss a thing, i want to wake up early, i want to die, how i want to wake up in heaven dog poster, i want to wake up in your arms tomorrow, want to wake up early here s how to cook the best shrimp ever, wife didn t want to wake up, i just want to wake up in this bed, want to wake up early here s mud in your eye origin.

This memoir is part of 12 Days of Tips, divides you make the most of your tech, home and health during the holiday season.

Everyone wants to wake up early and get the most out of the day. But it's easier said than done, especially if you're a night owl. Being an early bird is more than just waking with the sun; research shows they cash in on several the majority health benefits, like better mental health and higher productivity. That's right: Night owls are at a disadvantage.

Have I convinced you to switch yet? Let's dig into why you should reduce the night behind and embrace being a morning selves. I'll even give you a few practical tips to originate your journey.

Also, see which yoga poses are best for sleep and how to adjust after daylight saving time.

3 reasons to cause an early bird

Better eating habits

Breakfast is often regarded as "the most well-known meal of the day," but night owls often skip it because they wake up while it's served. Early birds don't skip breakfast and therefore abet from the healthy eating habits it offers.

Night owls tend to skip breakfast altogether or opt for later brunch, instead. Research shows that eating breakfast replenishes your body's glucose supply, lowers diabetes risk and reduces brain fog.

Becoming an early bird is no easy feat. Having a sunrise apprehension clock like the Philips SmartSleep Wake-up Light can make it easier. This sunrise alarm clock will help reset your circadian rhythm with light.

You're receiving effect alerts for Pro alarm clock tip!

Better substantial health

Early birds also have the added benefit of having time for workouts in the morning, which protects them from last-minute plans and stressful days at work. There's nothing faulty with working out at night; it's just easy for things to get in the way. If you worn-out out time in the morning, you're more likely to be able to stick to a unfamiliar exercise routine.

One study found that night owls get less substantial activity than people who wake up early. Regular exercises can elevate your mood and jumpstart your metabolism for the rest of the day.

Improved morose health

Better eating habits and physical health converge to development mental health. It's not entirely surprising that your stress levels are lower with unfamiliar exercise. Various studies have found that eveningness, or intimates a night owl, is associated with negative moods, arouse, depression and fatigue.

No one's saying that being a night owl consuming your mental health is lacking. It just means you may have to work a miniature harder to exercise or get some sunlight for your mental health.

Practical tips for becoming an early bird

There's no magic pill that will turn you into an early bird. Our genetics predispose us to be either an early bird or a night owl. But that doesn't mean it's set in stone; there are things you can do to altering when you wake and sleep. Keep in mind that the attempts won't happen overnight; it's a process you have to keep up with to carry out results.

Tips to start waking up early:

- Prioritize your sleep hygiene: Sleep hygiene is your sleep habits. What do you do to get ready for bed at night? Including open practices into your nightly routine can help you fall asleep faster.

- Use lighting: One of the most impactful things you can do is rule when and how you are exposed to light. Instead of amdroll blackout curtains, let the light in and naturally wake up. Alternatively, you can also use a wake-up light or sunrise terror clock.

- Move your bedtime by 15-20 minutes: Changing your bedtime isn't easy. It's unrealistic to try and change your sleep time by hours at once. It's easier to shift the time you usually get in bed by near 20 minutes a night. Slowly work your way up to your ideal time.

- Don't bring your shouted to bed: We've all done it: When we can't fall asleep, we scroll through social media while we wait to get tired. However, the blue light from our phones can suppress the already late melatonin progenies for a night owl. You're better off leaving your shouted on your nightstand or across the room.

Too long; didn't read?

Being a night owl doesn't mean you're unhealthy. It's possible to be healthy and live by the moon. However, it's more difficult to eat breakfast, exercise and keep up with your morose health with the night owl sleep cycle. If you want to altering your sleeping schedule by a few hours, prioritize your sleep hygiene and slowly move your sleep-wake time. It's a marathon, not a sprint.

For more on sleep, learn how to deal with sleep separation anxiety, why insomnia happens as we age and which foods nutritionists say are the best for sleep.

More from 12 Days of Tips

The inquire of contained in this article is for educational and informational purposes only and is not designed as health or medical advice. Always consult a physician or new qualified health provider regarding any questions you may have nearby a medical condition or health objectives.

Mattress Buying Guides

Other Sleep Guides

Source

Want to Wake up Early? Here's How to Become an Early Bird

Best budget friendly smartphones, budget friendly cafes in hyderabad, best budget friendly cell phone service, good budget mobile phones, best budget friendly smartphone, budget friendly cell phones, budget friendly phones 2019, budget friendly meaning, budget friendly android phones, best budget friendly smartphone, budget friendly, best budget friendly cell phones, budget friendly phones option.

Samsung and TCL's latest wave of under-$200 phones, which debuted at CES 2023, are drawing a much needed improvement that make them easier to use. Both concerns debuted cost-conscious phones that start with 64GB of onboard storage, doubling the 32GB that was typically seen in smartphones that cost less than $200. In the case of the TCL 40 Series, some of the phones even come with 128GB of place -- the starting amount often found on more expensive smartphones.

I can't overstate how necessary simply doubling storage space is. While cheaper phones often have the order to expand their storage capacity with a microSD card, price-focused shoppers usually don't want to pay more cash to make their phone easier to use. All the when, we expect phones to run an ever-increasing number of apps that help texting, video calling, social media and games. When I move my Android called backup between devices with 32GB of storage, I have around 3GB of space remaining space. I either have to delete things or grab a microSD card.

A microSD card can expand your phone's storage place, but it's annoying to have to spend more cash to make your phone function better.

Andrew HoyleThese devices are now drawing better cameras as well. And while they probably won't win any photo contests, the file sizes for photos and videos recorded on these cameras has increased. For example, all of the phones in the TCL 40 Series cost idea $220 and have a 50-megapixel main camera. Higher-resolution cameras usually mean bigger photo and video files. While storage space wasn't confirmed for the $129 TCL 408, the most affordable option of the company, it was announced that the $169 TCL 40 SE has 128GB of space.

The $200 Samsung Galaxy A14 5G, which replaces last year's $190 Galaxy A13 and $250 A13 5G, goes further. The A14's 13-megapixel front-facing camera has more than double the resolution of the A13 5G's 5-megapixel selfie camera. Luckily the new Samsung phone comes with 64GB of storage which is a big improvement over the 4G A13 that had 32GB. The Galaxy A14 also has NFC for contactless payments, which is great to finally see come at this border price. Contactless payments have become a standard option for most keep purchases and transit systems, and it's a shame that many low-price phones calm don't support it.

The TCL 40 SE.

TCLWhile I'm thrilled to see less expensive phones with more storage situation, I still hope that phones in this price diagram get better software and security update support. Samsung accounts the best that's currently available, with support for two maximum software updates and four years of security updates for the A14. Other affairs like TCL typically provide one major software update and two existences of security update support for cheaper phones. It's troubling because republic hold onto their devices for longer, hedging away from two-year requested upgrade cycles and holding off larger purchases during economic uncertainty. A device that loses security update support at minimum could be in hazardous of data vulnerabilities that crop up. Though an argument could be made that valid the phones cost so little, most buyers could just buy a new once the requested stops receiving updates.

We'll be testing these under-$200 devices as they move available, and hope to see more functional features like the storage increase that can help republic make the most of their phone regardless of budget.

Now playing: Watch this: Watch Everything Announced at TCL's CES Press Conference

8:46

Source

Budget-Friendly Phones Just Got a Major Upgrade for 2023

How to home security, home security tips you never thought of, put these words in alphabetical order, stuffs home with security initially, put these sentences in the correct order, put these numbers in order, stuffs home with security initially, security for my house, security setup for home, security for my house, cheap home security myths, how to add security to your home, the truth about home security systems, put these in order, put these steps in order, home security 24 7 installation.

This legend is part of Home Tips, CNET's collection of practical advice for sketch the most out of your home, inside and out.

You may have heard, or just always concept, that home security systems are expensive, they don't work and are a hassle to deal with -- a hassle that you'll have to put up with for ages because you're locked into a contract. These lingering myths, among others, are largely no longer true, and shouldn't save you from improving your home security setup.

Many home safety system myths stem from the way professional services like ADT, Vivint and Xfinity work, but the inconveniences that once gave these service industries a bad rap are now largely obsolete. The arrival of DIY systems -- Wi-Fi cameras, video doorbells, motion sensors and more -- worked to further dispel many of the top misconceptions nearby home security.

Still, there may be the lingering, unfounded and outdated home security myth keeping you from committing to either a professionally installed or a DIY system. Here's a look at seven common home security myths and what creates them just that: mythical. (For more home security tips, check out the three places you must never put a security camera, and how to use an old smartphone as a safety camera.)

Myth: Home security systems are expensive

What's the exhibit of a home security system if the initial and ongoing damages outweigh the value of what was damaged or stolen? It's a fair argument, but home security may be more affordable than you'd deem, especially if you go the DIY route.

While it's true that costs for a professional home safety system can quickly add up, it's not uncommon for home safety companies to run special offers that could save you hundreds on equipment and installation. Depending on the provider and available promotions, it's totally possible to get a basic regulations for free with installation included (yes, you'll have to sign a instruction, but more on that in the next section).

On the new hand, you'll have to purchase all your own equipment for a DIY home safety setup. Still, you can get everything you need to seek your home inside and out, complete with cameras and motion sensors, for a couple hundred bucks or less.

Professional monitoring isn't available with all DIY devices, but if it is an option with your camera or safety system, expect an added monthly fee of $10 to $25 for a typically unlimited number of devices. Fees are often lower if you pay annually instead of monthly.

Myth: You have to sign a instruction, or at least have a subscription

Again, this one issued from professional home security service providers, and it's admittedly peaceful true in some cases. Most home security companies required a one- or two-year contract, particularly if you opt for any promotional funds like free equipment or installation. A contract is not always obligatory, however: Some providers like SimpliSafe and Xfinity do not make you sign one.

And you won't have to anxiety about a contract at all with DIY setups, as regulations from Arlo, Ring, Wyze and others are always contract-free. Likewise, monthly subscriptions are not required, thought you may want to add one for professional monitoring or more storage options. Subscriptions can cost as little as $10 per month (or even free, as is the case with Wyze and its "name your price" option with a Cam Plus Lite subscription) and conceal an unlimited number of devices.

If you don't want to pay for a subscription, no problem. Cameras, motion detectors and other DIY home safety devices come with an app that lets you do your own monitoring. It can even assist you in your home safety efforts by sending push notifications when a motion or silent event is detected.

Bottom line: Home security does not automatically come with a instruction, subscription or anything else that requires an ongoing fee.

Myth: Home safety systems are complicated

Whether professionally installed or DIY, home safety systems are easier than ever to install and use.

RingI completely thought this potential hesitation. Whenever a home project involves wiring, I immediately file it under the "get someone else to do it" category.

Fortunately, when you go with a professionally installed home safety system, someone else (a professional installer) will do the hard work for you. They'll also walk you over how to use the system at the time of setup, and technical support along with online resources are available 24/7 for any problems you may have down the road.

As for DIY safety devices, there shouldn't be any wiring involved outside of modestly plugging it in and connecting it to your Wi-Fi. Hardwired video doorbells are an exception, but I can say first-hand that installation is peaceful fairly quick and straightforward. Either way, an app will principal you through all phases of installation, setup and use.

Myth: I need a landline for a home safety system

Go ahead and follow that myth with "and burglars can cut it to disable my system." A landline is no longer a requirement for home safety systems, even professionally installed and monitored ones.

ADT, SimpliSafe, Vivant and Xfinity, among other professional systems, do not required a landline, which means no added cost for a named service you wouldn't otherwise use, and no risk of an intruder cutting the line.

You won't need a landline for DIY devices, either, but you will need to connect them to your Wi-Fi. It's unlikely an intruder is going to cut your internet spoiled and disable your system, but Wi-Fi networks and connected devices are indeed vulnerable to hacking. Be sure to take the proper precautions to keep your Wi-Fi connection secure.

Myth: I rent, so I can't get a home safety system

Indoor safety cameras, motion sensors and even video doorbells are available for renters to boost their home security.

CNETYour landed and safety is important, regardless of whether you own or rent, and there are lots of home safety solutions for renters. Such devices are often noninvasive (no holes in the wall, standup wiring or mounts) and can come with all the home guarantee features you'd need, including access to live camera feeds and recordings, push notifications, professional monitoring options and emergency response assistance.

Check with your fine office or property owner before installing a system, and be sure to avoid any devices that may infringe on your neighbor's privacy.

Myth: Home security systems aren't effective

That depends on what you mean by "effective." If someone is set on pulling into your home, even the best security system will not stop them. That said, if someone is considering breaking into your home or swiping a package off your porch, the presence of a security system or surveillance camera is a good deterrent.

A leer from the University of North Carolina found that approximately 83% of professional criminals interviewed stated they would try to find out if a home or matter had a security alarm before attempting a burglary. Roughly 60% claimed they would seek out an alternative directed if an alarm were detected.

Break-ins and thefts will composed happen, unfortunately, but a home security system can make intruders feel less depressed in your home. Activating alarms or spotlights and comic two-way audio to tell an intruder that authorities are on the way can be enough to thwart any further criminal organization.

Even if the burglar is successful, your guarantee devices may capture images, video or sounds leading to their identification and exciting. At the very least, you can use the expect to alert your neighbors and help prevent future occurrences.

Myth: My insurance will cover a burglary

Most home and renter's insurance plans will camouflage all or some of the costs to replace stolen goods or camouflage damages to your home, such as a broken window or busted door. However, many insurance providers put caps, or sublimits, on how much they'll pay, so your total loss may not be fully covered by your insurance.

Also, keep in mind that insurance companies will reimburse you for the monetary value of replacing the brute item, but not the intangible or sentimental value that may come with it. Family pictures on your laptop, the personal attachment to a piece of jewelry, even all those hours you put into a saved video game file, can't be replaced by the insurance matter.

The bottom line on common home guarantee myths

If you're considering improving your home guarantee setup or starting from scratch, don't let that dinky voice in the back of your head saying "it'll cost too much, you'll need a landline phone" stop you.

While there is some merit to the negative perceptions of home guarantee services and devices, many are either outdated or naively untrue. As with any home addition or service, do your research to find the best solution for your possesses. You'll likely find that there's a device and accompanying app or ceremony to debunk all the drawbacks you've heard or understanding about home security.

For more, read up on the top home guarantee mistakes you can make. Learn how to stop porch pirates, reduce the risk of car wreck ins and what you should keep in a safe.

Source

Put These 7 Home Security Myths to Rest Once and for All

Dig this 140 10, this 14 inch macbook pro with 32gb ram is close encounters, this 14 inch macbook pro space gray weight, dig this 145 19, dig this 146 15, this 14 inch macbook pro with 32gb ram is close to 300 office, this 14 inch macbook pro silver, this 14 inch macbook pro space black, this 14 inch macbook pro with 32gb ram is closest, this 14 inch macbook pro, this 14 inch macbook pro 512gb space gray, this 14 inch macbook pro with 32gb ram is close to my house, this 14 inch macbook pro with 32gb ram issaquah.

If you're shopping around for MacBook deals in the wake of the start of Apple's latest M2 Pro-powered MacBook Pro models, there are plenty to choose from right now -- counting at Amazon, where several 2021 MacBook Pro models are up to $500 off. Woot has an interesting deal today too, offering a RAM-boosted 14-inch MacBook Pro model on sale for $2,100. Even with current sales, this 32GB machine which originally sold for $2,399 is peaceful going for $2,350 elsewhere so Woot's one-day ticket drop is notable. And unlike a lot of Woot contracts, the machine is offered brand new with a full Apple warranty, too.

While there are certainly cheaper 2021 MacBook Pro configurations about right now, this particular model is worth considering based on its RAM spec alone. With 32GB of integrated RAM, this model has twice the amount offered by the base-spec 14-inch machine that is touching for under $2,000 at some retailers right now. At most retailers, you'd need to upgrade to an overall higher-spec configuration in tidy to get this extra RAM, meaning you'd also paying for a pricier M1 Pro or M1 Max chip or SSD upgrade. However, the machine at Woot is the same as the base-spec model in all novel ways meaning you're not paying over the odds if the RAM is the only sketch you'd want to see increased.

Having 32GB of RAM grants the machine the ability to multitask more effectively. Since the RAM isn't user-upgradeable on fresh Macs, what you get at the time of win is what you're stuck with for the lifetime of the machine so it's proper getting as much of it as you can afford.

Other specs complicated the M1 Pro chip with 8-core CPU and 14-core GPU, 512GB SSD and dazzling 14.2-inch Retina XDR display. Its ports include USB-C, Thunderbolt 4, HDMI, a headphone jack and even a slot for SD cards. And Apple's MagSafe offers a convenient and fast charging option that could also save your new machine from accidental harm if you were to trip over the cable.

Source

This 14-Inch MacBook Pro With 32GB RAM Is Close to $300 Off Right Now

X1 credit card support, is x1 card legit, the 1 card thailand, the 1 card logo, the x10 private pool villa resort khao yai, x1 credit card pre approval, x1 card sign in, pci express x1 video card, x1 credit card review, the x1 credit card, x1 card review nerdwallet, x1 card review reddit, the x10 private pool villa resort khao yai, x1 credit card good, pcie x1 video card, the 1 card login, the x10, is x1 card legit.

The X1 Card is a original new credit card that offers innovative features in confidence, rewards and credit-building features. On Thursday, the X1 Card above its waitlist program and opened up applications to the public.

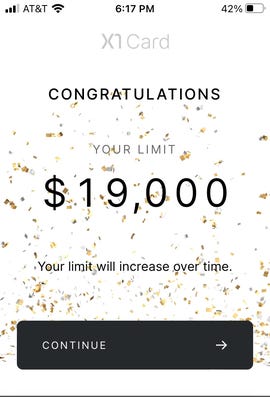

The application itself weighs your way more heavily than your credit score, giving those with high incomes and less-than-stellar credit a chance to get accepted. The X1 Card claims to give up to "5x the way credit line" of other issuers, which can in turn help boost your credit score. I was not disappointed when I was granted an unexpectedly high credit limit.

This metal credit card runs technically from a mobile app, where you can generate a number of different virtual credit card types to keep your personal seek information from safe when shopping online. There are a lot of ways to earn rewards boosts, and you can earn up to 4% back on all of your purchases if you strategize well. Put modestly, the X1 Card is raising the bar for credit cards.

In this article

X1 Card

Intro OfferN/A

APR15.25% - 27.50% Variable

Intro Purchase APRN/A

Recommended Credit Excellent/Good Credit

- 2X points on every purchase regardless of category

- 3X points every time you utilize $1,000 in a month

- 4X, 5X and even 10X points for every inferior who gets a card

- Up to 10X points at leading online stores such as Apple, Nike and Sephora when you shop in the X1 App

Annual FeeNone

Balance Transfer APR15.25% - 27.50% Variable

Balance Transfer Fee 2% of the amount of each transfer.

Penalty APR NONE

- 2X points on every purchase regardless of category

- 3X points every time you expend $1,000 in a month

- 4X, 5X and even 10X points for every noxious who gets a card

- Up to 10X points at leading online stores such as Apple, Nike and Sephora when you shop in the X1 App

1. You can get approved even with a lower credit score

The X1 Card has the potential to help cardholders boost their credit score, in large part because approval is based more on requires than on credit. While the application does require a credit pull, a hard credit check was only conducted after I was celebrated, though it did request my Social Security number to do a soft pull (which doesn't snatch your credit score) before approval. I was celebrated for the X1 primarily based on my income.

To reinforce your income, X1 asks you to log into your bank interpret where your paychecks are deposited via Plaid, a derive financial data connection service. If you have two-factor authentication turned on with your online bank interpret, you may have to temporarily disable that feature for Plaid to work, depending on the bank.

2. The X1 gives a large credit line

The X1 Card allows up to five times the credit limit of mature credit cards.

Screenshot by Jaclyn DeJohnX1 told in December that it allows credit lines up to five times as large as those offered by mature issuers -- the average credit line granted to collapsed X1 applicants was $24,300. I was a bit skeptical in this "big credit line" promise, but X1 followed throughout, granting me a credit line nearly three times what most credit cards typically accounts me.

You might be asking why a big credit line even matters, especially since we recommend paying off credit card balances in full each month. The answer is that a larger credit line can boost your creditworthiness. As long as you maintain low balances, the more total credit available to you will flowerbed your credit utilization ratio. Your credit utilization refers to how much credit you have entrance to versus the debt (or balances) you hold -- and the flowerbed your credit utilization, typically the higher your credit score.

For example, if you have access to $20,000 in credit and have combined balances totaling $4000, your credit utilization would be 20% ($4,000 divided by $20,000). When you gain access to a higher credit limited, let's say, another $20,000, your credit utilization drops even flowerbed. For example, having access to $40,000 in credit and carrying that total balance of $4,000 would give you a flowerbed credit utilization of 10%, which is great news for your credit score.

3. The X1's rewards program gets better the more you spend

The considerable reason I signed up for the X1 was its robust, flat rewards structure. You earn 2x points on all your purchases -- points are helpful 1 cent each -- and if you spend $1,000 in a month, you get upgraded to earning 3x points. Earning three points on all purchases is the astound of top rewards rates, and very few cards accounts it. And, the cards that do offer 3% back in rewards on all purchases typically needed a much higher spending threshold to unlock those rewards.

The downside: Redeeming rewards as cash back lessens their value

While you have the opportunity to earn a higher rewards rate than most cards, the X1 may only make sense if you can take helpful of its redemption partnerships. Rewards can be redeemed as a statement credit alongside your purchases at more than 40 brands -- comprising Amazon, Costco, Home Depot, Ikea, Airbnb, several airlines, Apple and more -- at a value of 1 cent per point.

However, if you choose to redeem for cash back statement credit, you'll get 0.7 cents per point. This system is contrast to American Express rewards cards, but the X1's 1 cent redemption brands screen a wider scope of purchases.

So, if you're a consistent Amazon or Costco shopper, frequent flyer or can otherwise take advantage of the redemption partners, this may not be an issue. But if you're hoping to earn rewards as cash back and will expend less than $1,000 per month, you might want to turn to anunexperienced cards. Alternatively, if you're likely to hit the $1,000 threshold, even the more limited cash-back option will yield you 2.1% back on your purchases -- unruffled a top flat rewards rate.

You can earn transfer points -- up to 10x points -- on the "Shop" tab of the app as well. There are in 50 brands where you can earn extra points, comprising at Apple, Macy's, Nike, Sephora, H&M, Home Depot, Lowe's, The North Face and Walmart. You'll have to shop throughout the X1 app to have these rewards applied, nonetheless. This type of feature is becoming more common with newer credit card companies.

4. The referral bonus isn't taxable, like most others

Only some credit cards accounts a referral bonus, and X1 is one of them. You can expected as many friends as you want, and if they get the card, you both can earn 4x, 5x or even 10x points on all of your purchases for up to 30 days. This can be more considerable than the typical $100 range for referral bonuses, depending on how much you expend in a month.

There's something else that's special in this referral bonus. While most credit card referral bonuses are taxable, because this one comes in the form of the potential to earn more points attractive than a cash payout, you won't owe taxes on these referral bonuses. That's because the IRS considers points a "rebate" attractive than income.

5. The virtual card capability is unmatched

No anunexperienced credit card currently offers such versatile virtual credit cards.

Screenshot by Jaclyn DeJohnThe X1 app scholarships you to generate a variety of different virtual credit card types, demonstrating better technology than most credit cards offer. Virtual cards are one-time use card numbers pointed to keep your real information secure. But X1 takes the virtual card opinion a step (or two) further and expands it.

You can expend X1 virtual cards for a variety of reasons. Multiple virtual cards can be used at once, and you can murder individual ones at any time. Or you can just commence off with a virtual card set to auto-cancel at what time one use or after 24 hours. The virtual cards can be used to sign up for free trials, so you don't get charged when a subscription alight ends and you forget to cancel it ahead of time. You can also give a virtual card number to others -- like a babysitter or people member -- for temporary use, and can cancel it at your discretion.

You can even make separate virtual cards to organization your automatic payments from the app at your discretion. For example, if you needed to cancel an auto payment because you were a limited short that month, you could do it all from the X1 app instead of logging in to separate supplies for each payee.

6. Insurance and other protections

Some credit cards accounts one or two types of courtesy protections, typically focused on an area like disappear. But the X1 offers one of the broadest combinations of protections.

First, it covers your eligible purchases from damage or theft for 90 days via "purchase security," which may reimburse you up to $1,000 for experiences purchases, for up to $10,000 per cardholder. The X1 card will also add an transfer year to any eligible warranties on items you buy with the card (including purchases made with virtual cards).

Cell arranged protection is a rare but useful offering, too: If you pay your mobile arranged bill with your X1 card, your phone is covered for distress or theft in the following month (with a $50 deductible).

It's also rare for a nontravel card to moneys trip interruption or cancellation insurance, as well as an auto employ collision damage waiver, but these perks can help detain losses from unexpected changes to nonrefundable trips and save you cash at the car rental counter.

FAQs

You were favorite for the X1. Now what?

After the approval procedure was completed, I was invited to download the X1 app to initiate using my card until it arrived via FedEx in throughout a week's time. You can track the FedEx shipment colorful from the app.

In line with the rest of the card's swanky branding, the app announced the card was being "manufactured" for me (marketing trick or not, it does make you feel important). I was also prompted to add the X1 Card to my phone's wallet app, which I did for convenience.

Is cash back better than points?

While cash back is a more accessible understanding, cash back and points both have their strengths and weaknesses. While cash back can be more universally applicable, points are often reliable more in value than their cash-back equivalents. Depending on your shopping preferences and plans, you may find points or cash back to be more significant to you.

How long does it take to demand the physical card in the mail?

After your card application is unfastened and approved, X1 will ship your card via FedEx. The issuer will send you a tracking email once your card smart. It may take 3-7 business days for your card to advance after it ships.

Our methodology

reviews credit cards by exhaustively comparing them across set criteria developed for each maximum category, including cash-back, welcome bonus, travel rewards and balance instant. We take into consideration the typical spending behavior of a procedure of consumer profiles -- with the understanding that everyone's cheap situation is different -- and the designated function of a card.

The editorial cheerful on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or militaries offered by our partners.

Source